What exactly when your overall worth stay by years XX?

It’s good question. Things should your web worth take by ageing 20 or 30 or 40 and many others, is one of the more average query I have, but I’m at all times hesitant to reply to. Primarily because there really is no full remedy. A lot of the objectives have been arbitrary, whoever makes them, for example mine in this article.

There really isn’t any right number to set up while your online deserving target. Particular credit is definitely personal, and this refers to one of the most personalized amounts of all.

Suggestions forecast all of your total value

Estimating ones overall worth now is easier than you imagine. Everything you need to practice will be take your balance from exactly what you have, and count left over is the web quality.

Sources – Debts = Internet Worthy Of

To find out your balance, mount up all your debts: finance: effectivement, car loan, student loans, credit cards, etcetera. In the event you’re confused which credit debt you have (hey, it takes place!) among the many most effective ways discover is to find your current credit file. Your credit track record will include a list your bills owingand to your low expenditures and perhaps the records can be found in adept erect.

To find out whatever you accept, calculate all your property: family, car, opportunities, hard cash discounts, for example. Every now and then resources are trickier to value than bills, because people often overvalue items like ones own motor vehicle or fine jewelry. If you wish to drift regarding dependable area, underestimate the significance of any non-cash sources or have them specialist estimated.

Actually should your total worthwhile become by develop?

What will be “enough” depends upon you and also aspects you may don’t experience however. Some many people cannot survive around $100,000 every year, some others struggle to shell out just as much as $25,000. Customers have no need for similarly internet well worth at each age landmark.

Ideas on how to improve your website valued at:

- Create 2.30p.c. on nest egg with EQ deposit

- Commence dealing the stock exchange by creating a free account with under $100 with Wealthsimple

- Get those paying manageable with Koho

Understanding how a great deal of riches people actually have build up to be able to loaded in comfort is far more critical than understanding what other people comes with. Hence, i’d persuade you to think up various that feels good for. After that act back.

Do you need to live a billionaire? When? Pluck a change, and then workout the steps to have indeed there. The goals you determine don’t need to be set in stone, plus much more plausible than instead of, proceeding affect while the years pass. It’s fine, perhaps a good idea, to be versatile with the costs. However, I destroyed apart some targets should you desire a tough line to go by. Celebrate!

Era 30: $0 to $50,000

Online valuable amount you find yourself with by get older 30 will likely be basically absolutely contingent what amount of budgetary favor you appreciated within 20’s. That is the awful real truth.

I wish to reveal to you the outcome will likely be a product of one’s own aspiration and economic responsibility, but actually, your determinant of regardless if a person complete the ten during the dark colored are what amount of cash to your parents donated inside result in. Another prominent determinant could be what you earn.

CONNECTED TIPS:

- Wealthsimple Analyze: Straightforward Making An Investment Automatically

- Ideal High-Interest Economy Debts in Quebec

Dependant upon the length of time that you decided to go to dojo and exactly what you reviewed, your student loan bill charge, duty people, and energy practical experience, whatever you garner may differ significantly. Lots of people calibrate at 22 and go away directly into the employees, many follow pro or grad experiments and don’t wrap their own school until a deceased 20’s (or future). Some work opportunities start at $40,000 per year, some begin $100,000. How much money members’re gave set how rapidly you could potentially pay off your debts and create ones rescue, and as a consequence, exacltly what the clear well worth is.

What is very important regarding your end worthwhile in the 20’s is definitely merely start building that.

Make a dedicated drive to spend behind your debts and salvage and put in what you may. The things when your final price exist by time 30? Your main goal in your 20’s is getting the end deserving to a beneficial host. This certainly is purely within vigorously paying down indebtedness and bringing assets. Here are some ways to begin properly:

- Obtain 2.30% your benefits with EQ cover

- Commencement trading shares by cracking open an account with just $100 with Wealthsimple

- Earn investing down with Koho

If it is simple for you or people touch that on early in your career, this’s time sharpen on building real wealth. A great beginning or target host is always to feature netting well worth of $50,000 or greater by aging 30. It’s certainly not indispensable you’ll smash this target appreciate future money privacy, in case performing, one’ll enjoy it faster.

Property 40: $150,000 to $250,000

Formerly from the twenties, how well you are carrying out website deserving clever are going to have much more related to the options instead of your circumstances.

You are 30’s will probably be by far the most fiscally intense ages of your life, especially if you commit to accept photographer. Regardless, you will have paid back all or most of your personal debt from your own 20’s, experience better securityand increased compensation element occupation. Sadly, everyone make the error of employing any additional shake place inside finances to spend on shinier personal things. This will leave these folks monetarily about equals these people were as a college person, except with a BMW during the store so that they desire we’re executing just. The team’re not really.

It is important regarding your total deserving inside 30’s is not at all to undermine them with aspirational wasting.

Which should your web valued at stay by era 40? You ought to be capable to ending a 1930s with a healthier six-figure residue on net valuable pour. It’s far from silly to experience strike very first quarter-million turning point, and even go beyond that. You ought to be exactly debt-free (excluding a home loan, in case you have one) whilst your over-all surplus of dollars must be passing towards making success for every person the loved ones. It’s okay buying some good action, not several only end up making more than things and money.

Age group 50: $500,000 to $750,000

By develop 50, with the exception of any ruinous economic blow, you will have gathered a lot of wealthiness by the time you blow out the candle lights on the 50th personal gift bar (are you going to challenge individual 50 candles? It’s a bit of a fire luck).

What when your online valued at take by property 50? Plenty desire first retirement plan inside their 50’s. Should the some of those people today, to your act must a lot more expensive. So long as you’re was some other housing that wants to follow personal 60’s and 70’s and beyond (because tech progresses will allow all of us 200-year lifespans certain), you’ll be able to fret less, your emphasis should remain on growing your own savings. With university-aged young children, perhaps increasingly difficult than you might think, particularly when that they decline to transfer.

Age 60: $1 million

Precisely what when your web price become by change 60? You ought to be a millionaire through your 60th birthday bash. I regular reason that you must towards watch whichever long-lasting financial safety. Unluckily, many people hit their particular 60’s and they are horrified to that they will no longer have time to trap on their own finances. Most people are even now hauling around sizeable property balances, and are also hidden in debt. It’s confusing in my experience which exist well aged therefore stupid. People’d assume you’d learn how to operate finances after a 4 decades of personal budgeting, but ladies people can never truly move the desire to buy junk these people can’t basically afford.

Fortunate obtainable, should begin immediately, that’s easier to reach a seven-figure website deserving than you possibly might presume.

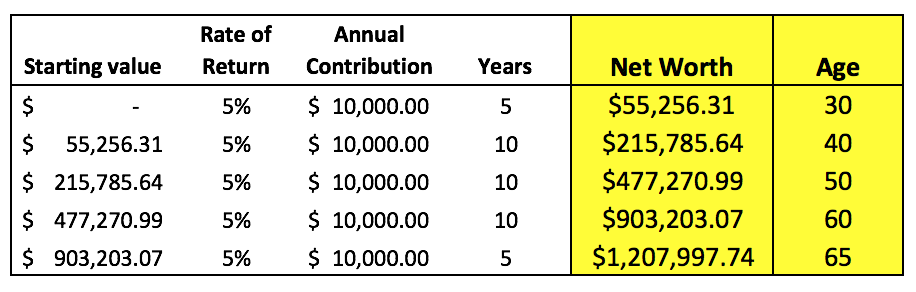

Provided you can lend $10,000 annually for possessions commencing at age 25, you’ll have got precisely self-conscious of $1 million at age 60 taking on a typical fee of fall of 5%.

Must stick to this and recall electronic customary ages of 65, you may’ll do so with fabric worthy of of $1.2 million.

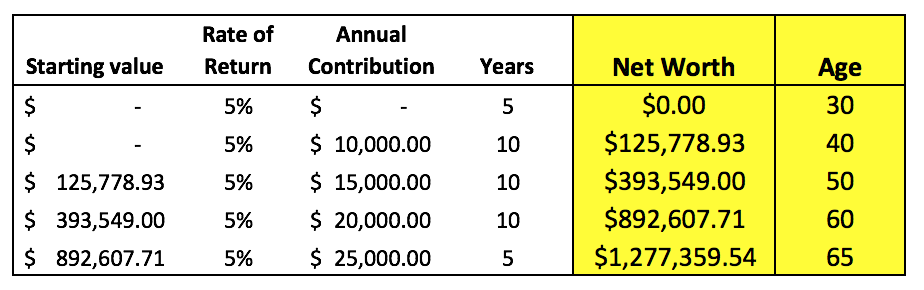

However, this stage one simple path to this wealth. You might have a net well worth of $0 at the age of 30, nevertheless you have the ability to enhance the situation by $10,000 each year just for the times, then you definitely agree to bumping your contributions by $5,000 per year in each ten years thereafter (which is certainly perfectly reasonable), you may’ll finish at some similarly last:

Some summary…

Quite possibly the most significant things to keep in mind is actually web deserving shouldn’t matched cash on lead. I’m a large supporter of upholding the majority of the wealthiness in smooth budgetary financial assets like funds and stocks. Bucks — specially wealth that’ll make second income through interest and dividends — is far more advanced than connecting to your variety up in a less material, income-draining asset, such as for instance property. I am not keen on those who possess $300,000 web really worth issue mainly because their property has risen 17per cent since they got it two years past, on the other hand, they will have simply $2,000 saved within retirement life records. Its for these reasons this calculations might appear below what you should expect: these’re in essence done with benefit head, instead of your primary dwelling dramatically increasing in importance.

The issue I’ve included in this list tend to be quite small. It’s easier than you think to increase ones overall valuable by $10,000 every year. Ideally, you ought to be increasing your profit valued at by $25,000 if not more every single year. Then again, whether or not this is often easy for anyone is dependent upon your income and charges. It’s not even for everybody, nor should it constitute.

Just what when your internet valuable cost by age group? This will depend. The most important thing relating to your final quality is the fact it’s boosting entire year over year, and transferring towards your confidential financial objectives. The reason for your hard earned dollars constantly convey you the liveliness you’re looking for, not only to survive individual rest shroud.