In savings, countless vibrant Canadians usually are baffled by whether to put cash into a TFSA vs RRSP. They may conveniently grown to be flooded by the complexness of both, these find neither, and ignore the great taxing advantages of both these consideration.

You must aim to have got both a TFSA and an RRSP, but in the case you’ll be able to no more than select one, the TFSA is just about the correct preference.

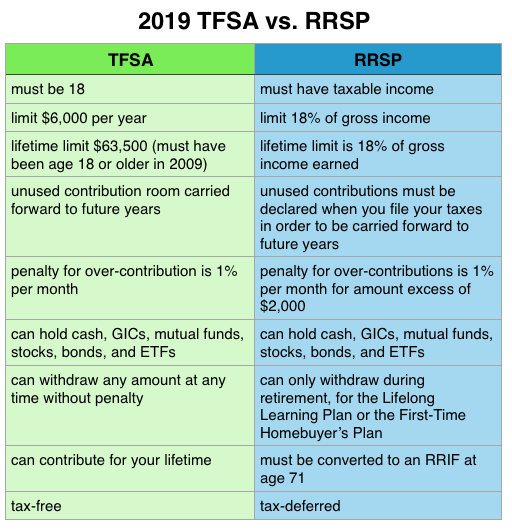

TFSA vs RRSP guide

The Tax-Free checking account (TFSA) and certified your retirement nest egg (RRSP) will vary plenty that it requires a while to spell out them very well. However, if that you’re on the go, the following’s a brief run-down equivalence:

Demand facts? Read on!

The TFSA and RRSP instantly

Both TFSA while the RRSP are usually tax-advantaged history, though are employed in different ways as well as have unique regulations. Then they’re element of photographer of certified profiles in quebec, this comprises the RESP. But unlike the RESP, the TFSA and so the RRSP tend to be retiring cost savings resources. tips a quick summary of each:

The Tax-Free Family Savings (TFSA)

The Tax-Free bank account had been launched in ’09 to assist Canadians not spend as much. Despite buying “savings” with its call, this balance can actually become more than a savings balance. You may retain GICs, mutual funds, handle, alliance, and ETFs in the TFSA. Read more information on the TFSA in this article.

The Qualified Your Retirement Savings Plan (RRSP)

The certified termination Savings Plan (RRSP) is usually a tax-deferred your retirement nest egg service. Despite buying “savings” in its name, this profit can also be used to waste. You can maintain GICs, mutual funds, broth, ties, and ETFs element RRSP. Look for a little more about the RRSP in this case.

Characteristics within the RRSP and TFSA

Both the TFSA and RRSP tend to be recorded balances. This means they have been associated with all of your cultural insurance policy amount plus the politics of Ontario screens to your advantages and withdrawals. As there’s punishment to over-contributions to both bill, as well as regulations relating to when you can unsealed one (years 18 for that TFSA and now have to have a taxable salary for RRSP) or what you are able tire dollar for.

The Tax-Free rescue Account and qualified retiring discounts Plan have “savings” in title, but neither accounting is restricted to keeping your payments as income preservation. Both the TFSA and RRSP it is possible to capture several assets as well as GICs, a mutual investment fund, stocks, bonds, and ETFs.

Both TFSA and RRSP can be good benefits motors for developing lasting riches. Top aim of both accounts must retirement savings, even so they can also both be employed to rescue for a down-payment on a property or payments to go back to college.

Differences between the TFSA and RRSP

The TFSA and the RRSP disagree on a couple of key things:

- ageing when you are able to yield a free account

- once-a-year info controls

- we contribution confines

- when you can finally do a cash out

Gap and adding to a TFSA versus RRSP

Be at any rate 18 to start a TFSA, but you can arise an RRSP at the time you act money-making financial gain. This means must’re 17 yrs old and dealing on a part time basis at Starbucks, might exposed an RRSP now (especially as long as they propose whatever employer-matching!).

The part cap for TFSA is the same for every Canadians: $6,000 per year. Nonetheless RRSP is certainly income recipient, therefore, the more than you earn, the more us’re allowed to added to an RRSP. For high-earners, the RRSP is a great tax-shelter given that it correctly lowers your own taxable money. This is one way lots of people acquire an income taxes discount for producing RRSP investments.

Retreating from a TFSA versus RRSP

Greatest benefits of the TFSA certainly is the flexibility to draw in history when, for any reason. Provided that there’s money into your TFSA, you may use the application for whatever you want! The RRSP, however, is created just about completely being a retirement discounts software. You can also make extraordinary distributions according to the beginning Home Buyers approach as well as the ongoing reading approach. However, these are typically loopholes as well as the more contribution, a person won’t be able to discover cash within RRSP until such time you truly relocate.

Because it is altogether tax-exempt, the TFSA looks a superior economy automobile toward the RRSP. If you’ve got the pick between raiding one history your alternative for a purchase, you should always remove your own RRSP foremost leaving the TFSA on their own.

Should you choose the TFSA or RRSP?

The small response is all people should have both a TFSA and an RRSP and attempting to maximum out both debts. Nonetheless, since that’s not easy comprehensive, what you want to concentrate on is prioritizing saving through the explanation that can help you the most.

The particular determinant as to whether you need to economize in an RRSP or a TFSA maybe cash flow. Good earners should get the RRSP a top priority within the TFSA, and deep earners should concentrate on the TFSA vendor RRSP. An easy guidepost is always to make TFSA a priority if you make significantly less than $50,000 annually, and the RRSP your current stress if you make beyond $50,000 a year.

I go since business in this posting: Do You Have To help with an RRSP or a TFSA?

We do hope you discover this announce a helpful strategies the TFSA vs. RRSP when considering your benefits aims!