The Tax-Free checking account gross annual contribution cap being increased to $6,000! This is the 2019 TFSA Explained, to help you maximize your hard earned money in the year.

Last year, government entities of Canada created the Tax-Free family savings (TFSA) to help Canadians cut costs. The TFSA signifies gain tax-exempt expenditure cash flow on dollar you devote to report. Second-hand adequately, our TFSA may become a $1 million dollar resource.

The Tax-Free Savings Account is hands-down the number one rescue and funding car offered to Canadians, but not many know the way it works. A number of put improperly, and more multitude don’t utilize TFSA anymore! We have found everything you must be informed on this new 2019 TFSA discussed, for getting essentially the most value for your money.

The greatest TFSAs in 2019

You could potentially organize a Tax-Free checking account at most of the banks. However, the sort of TFSA explanation and also the cost will vary radically. You have to seek the very best motion probable making use of the humble expenses!

Here are the ideal options to see for the new 2019 Tax-Free checking account:

- Wealthsimple – a roboadvisor that enables you to ensure you get your TFSA dollar helping you in the stock market, absolutely easy.

- Tangerine – an internet trust that can offer high-interest discounts and a mutual investment fund to assist you improve your TFSA quicker.

- Questrade – an on-line discount broker that may allow you to purchase and sell inventory, ties, and ETFs in TFSA at the lowest amount.

- Oaken Money – an online reserve which provides high-interest GICs to boost personal TFSA financial savings.

- Town depository financial institution – a credit union giving you high-interest TFSA cost savings information with no costs.

The Tax-Free Savings Account Explained

The Tax-Free bank account (TFSA) had been introduced during 2009 and Canadians with a tax-sheltered explanation thrive their. As the name implies, you might settle no fees of the net income obtained inside the TFSA.

The name as “Savings report” is actually inexact, because your TFSA really doesn’t actually have is a savings account. “Investment accounts” might be any descriptionbecause you are able to control trades like stocks, securities, a mutual investment fund, and ETFs within Tax-Free checking account.

Whenever you buy a TFSA, all stake, rewards, and investment gains you earn are tax-exempt. Wasting it the easiest way to utilize electrical systems Tax-Free family savings due to the fact frequently acquire high revenue choosing shares as opposed to saving money in a bank account. The bigger our investing salary in a TFSA, the higher the benefit we’re getting looking at the tax-exempt electricity.

That eligible for a TFSA?

Have you been 18 yrs old or previous? Is a legitimate sine list? Have you been currently a resident of quebec? Should you respond yes to all the three questions, PRAISE! You can easily opened a TFSA!

Comfortably, except where the aging to penetrate into authentic plans looks 19 years of age. When it comes to those districts and territories you will need to wait until your 19 years to open a TFSA. Fortunately, the contribution lessen place the day one get 18 is that included to your full-blown publication control.

Don’t spend a lot of your time outside of Ontario? You might be taken a “non-resident” for charge use. Check the CRA rules on what indicates a non-resident for assess objectives along with your TFSA.

Ideas on how to yield a TFSA

Opening a TFSA can be easy as opening a general bank account! One simply need to go for preferred lending company with government-issued detection plus cultural Insurance host and you will fit one up. Or even more! Consider, there’s no-limit to the TFSAs you determine away, simply a contribution cap!

Don’t believe forcing the property? Websites is fantastic for bypassing human being call throughout these events! Yes, you can even sign up for a TFSA online! Make absolutely certain you have still got a federal government I.D. and online insurance plan amount available. That you’ll ought to afford the direct content demanded as personalized on your own records to start your account.

There is certainly limitation to number of Tax-Free benefits bill you could have. Chances are you’ll want to have one TFSA to purchase the market and another TFSA for hard cash reductions entirely. I encourage:

- Wealthsimple

- Tangerine

- Questrade

You can get as many TFSAs as you want, nevertheless, you need be within your yearly and generation Tax-Free checking account publication confines.

The 2019 TFSA Part Lessen

In relation to cracking open and banking you are TFSA, there are two main amounts you’ll want to be exspecting: the total sum restriction along with lifespan donation bounds. There’s a synopsis below, but in the case you wish a very descriptive clarification, investigate position Strategy To evaluate all of your TFSA donation restrict.

The once-a-year 2019 TFSA contribution reduce

The TFSA once-a-year publication control is usually fixed each and every year. If the Tax-Free bank account was initially produced during 2009, the yearly publication bounds got $5,000. This chose as high as $10,000 twelve month, so cast backpedal to $5,500.You is able to see the gross annual malfunction for your TFSA donation restricts laid by way of the europe money Agency here. In 2019, the Tax-Free family savings info limit is $6,000. Nonetheless, you are able to discard more centered your age including a great deal one’ve set aside in a TFSA up to now!

The life time TFSA info reduce

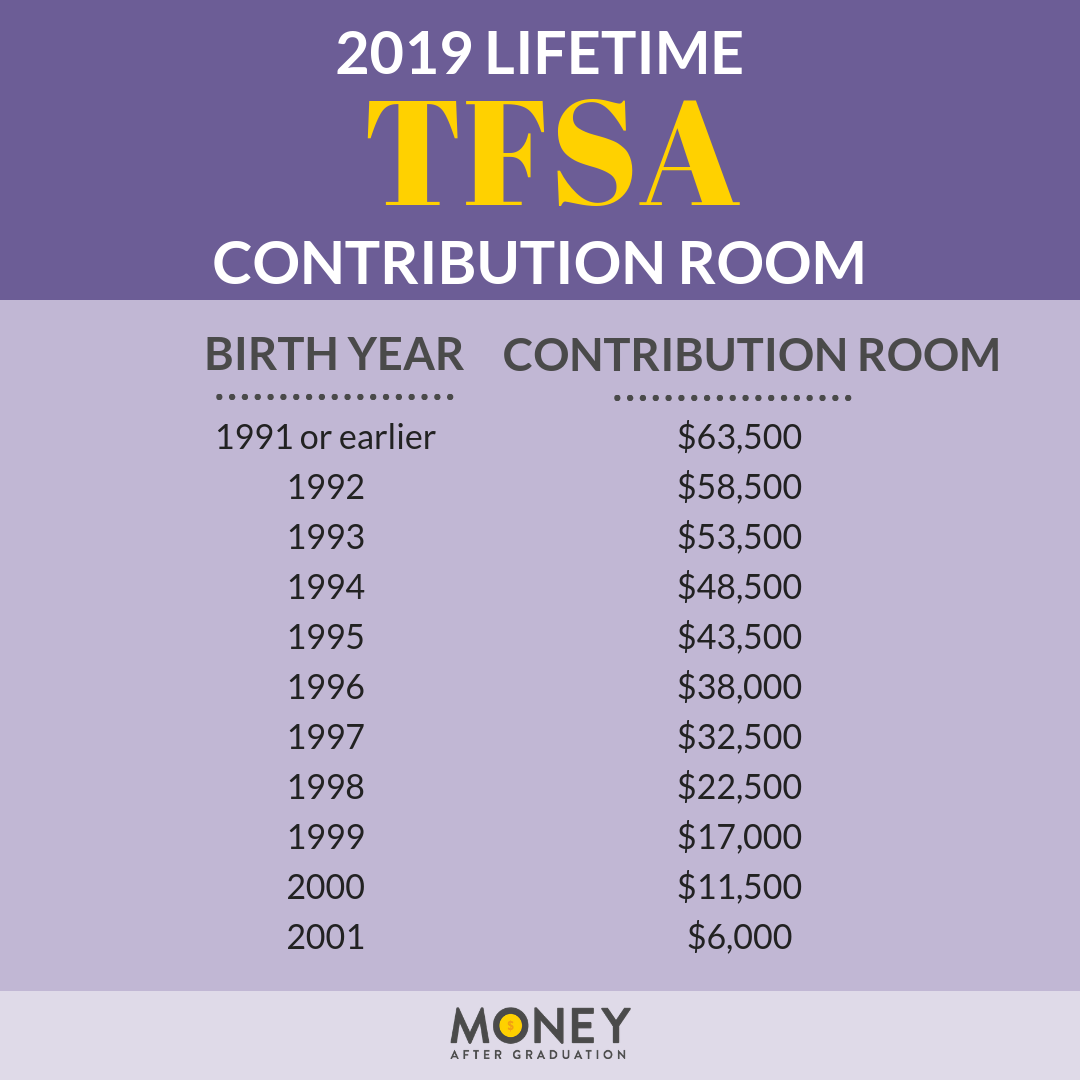

The TFSA life time bestowal bound may be the snowball absolute of once-a-year share controls within the year people turned 18. If perhaps you were 18 years last year, at that point you are entitled to the complete time donation area of TFSA. So long as you didn’t go 18 until after 2009, us’re entirely allowed the cumulative number of total bestowal bathroom starting in the year we rotated 18.

Testing your own 2019 TFSA share bounds

If you’ve got never had a Tax-Free family savings, or if you have not been conducive the utmost to TFSA yearly, you’ll learn regarding the abandoned donation area at this point. Therefore perhaps you are in a position to make a difference more towards TFSA compared to 2019 control of $6,000.

The brand new 2019 TFSA donation demarcation of $6,000 gives the TFSA life time publication demarcation to $63,500.

If you were older than 18 during 2009, that you’re allowed the entire $63,500 of TFSA sum house, minus any investments members’ve already prepared.

What to look for in a TFSA

Many people mostly explore your work for money information. Modern culture is conditioned consider. Using advent of the world-wide-web, certainly simpler evaluate institution merchandise. Given that the university you’ll be working for is certainly one of, or helps to keep finances with people in the Canadian dealers protective covering finance (CIPF) you shouldn’t accept a lot to be worried about. Joining the CIPF really signifies that you could get money during case of the organization intending insolvent, almost $1 thousand.

Averting costs

When purchasing best places to open up your TFSA, one of many aims must be the charge. Excessive costs can devour into the expense returns, and lower the money members’re making tax-exempt, entirely conquering the purpose of utilizing a Tax-Free family savings!

Investigate conditions and terms and watch out for any of the following:

- consideration fees and penalties

- lowest equilibrium expectations

- switch cost

- act cost

- managing expenses

- investment rates

Rates tends to be even number prices or a percentage of your respective equilibrium or expenditure earnings. Seek out a TFSA that delivers no-account, minimal equality, or inertia prices. Assuming you have a TFSA investment decision bill, remember to keep control costs under 1procent and trade rates must be lower than $10 per commercial.

The premium 3 tax-exempt cost savings records for Canadians

1. Wealthsimple

Wealthsimple enables you to spend money on the stock market element TFSA.

Wealthsimple is actually a robo-advisor. This really doesn’t indicate finances can be controlled by a bot, although it does means things’s treated on autopilot. There a genuine lively someone putting some investing conclusions behind-the-scenes, nonetheless they’ll be trading your money supported personal capitalist cross section and credit aims. All you need to perform is that position currency towards bill. This is best for young businesses who wish to get in the stock market but aren’t guaranteed where to start. It’s also ideal for competent option traders that don’t want the irritation of dealing with his portfolios. Buy 1st $10,000 with Wealthsimple handled f-r-e-e by visiting here!

2. Tangerine

Tangerine boasts TFSA financial savings data and TFSA mutual funds, so you’re able to save cash or use under that Tax-Free checking account coverage.

Tangerine comes with multiple dependable TFSA choices nicely. From inside the investment decision side of things these maintain thing nice and basic. Its rank is lower as compared to standard economical specialist at 1.07procent, in addition to the almost all what they are offering goods and services can include indexed by the search engines funding options. As a general rule, listed opportunities are likely to put up a diversified profile that for the most part sound businesses presenting “actively investments” campaigns.

3. Questrade

Questrade is usually an on-line specialist created for men and women that want to keep your rates down. Ones own bill organize is actually fairly stunning! They a self-directed speculator road that charges $4.95 to $9.95 per capital sell (1 quarter per supply, with a minimum change of $4.95). You can easily investment ETF’s, for FREE! Advertising him or her is identical value as selling inventory.

QuestWealth pages is the term regarding second method, where by individuals manage income based around you are buyer write. Alternatively 1-4procent rates like orthodox venture businesses, he determine 0.25procent control payment! Arm $100k in the account so this dribble to 0.20procent!

In the event you loose undoubtedly their particular TFSA higher curiosity rescue balances, you can make 1.25procent interest- concerning optimum in the field for a checking account. Tangerine’s TFSA GIC’s will be the premium at 3.5%. Neat thing of those history: no minimum costs and no stupid activity or alimony costs! Success!

Manufacturing a withdrawal from a TFSA

You may withdraw funds from your own Tax-Free Savings Account without handicap everytime. Unlike the RRSP, people don’t really need to be emeritus or a particular era to take via TFSA. You can also spend income nevertheless remember to without punishment. The Government of Canada won’t know (or proper care) when you use your own TFSA to take a-trip or help save for something different.

However, it’s necessary to do not forget that the TFSA is the most suitable applied as a termination financial savings car understanding that must certanly be your main goal because of this profit. Anyone don’t should gain tax-free expenditure income on the trip reductions, nevertheless, you need to have tax-free investment return on your retirement savings. Choose knowledgeably.

For those who produce a cash out from a Tax-Free Savings Account, the amount you retire is actually combined with personal donation limit the subsequent year. Create get rid of TFSA sum living space, and that is another powerful aspect of the accounting.

What occurs Easily Over-contribute To Our TFSA?

So long as you discover depositing extra with your TFSA in comparison to giving demarcation allows, you will definitely become exhausted. The taxation comes at a consistent level of 1percent a month to the optimum excess of our info, until recluse or until personal publication demarcation will increase adequate to constitute the bathroom.

For instance, if you were $2000 over you are bestowal limitation for just two several months, you would be exhausted:

$2000 letter 1% x 8 weeks = $40 of levy.

Insightful dot: you happen to be strained to the ultimate degree excessive before entire poise is within a contribution bound.

Say that you overlooked a restrict and travelled $4500 over. You know this 30 days late, but take over $4000, planning you had any additional shake location. a couple of months afterward, it is basically the new year and the share limit also increases. The following, you may’d constitute energized consideration as follows:

$4500 ten 1% x 4 weeks = $180.

Even if you remained $4500 over your current control personally week, you would be taxed as you were definitely on it for 4 several months. The maximum magnitude is that taxed until the good number is usually brought back beneath the sum reduce.

Clear as soil? The CRA includes more than samples in this case.

Will be TFSAs Simply For Wasting?

TFSAs are especially suitable for buying but could double more uses. Building up our disaster money? If you’re just starting to save, consider using a TFSA. My family and I made use of a TFSA i had acquired before we were fused as an emergency account. In a span of 12 months, there was a wedding event, got our personal number one environment, and had my number 1 newly born baby! Definitely not little operating costs!

The peace of mind that sported knowing that this payments got possible when we were definitely certainly anxious got a lifesaver! We owned some especially secure days in financial terms when all of our firstly small person appear. Understand the TFSA experienced wealth they could recede on reserved plenty of romantic relationship hassle.

Model 2019 TFSA Explained

Tax-Free Discounts History are great! The latest 2019 TFSA received a lot better with a contribution demarcation alter to $6,000.

Given that you have more than one Tax-Free Savings Account, they usually are for a variety of objectives. The TFSA wonderful area to deposit to your disaster investment, cut back for a downpayment, and construct the retirement plan savings. Just be sure to continue on your contribution restrict, and pick a cost-effective funding be a TFSA. Look on the balance develop take pleasure in ones go to personal liberation!