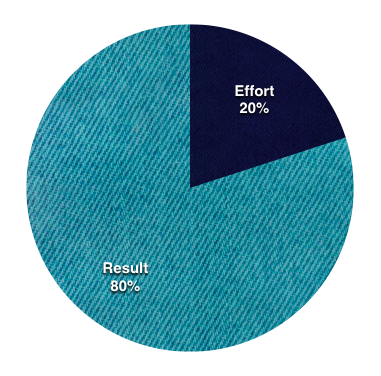

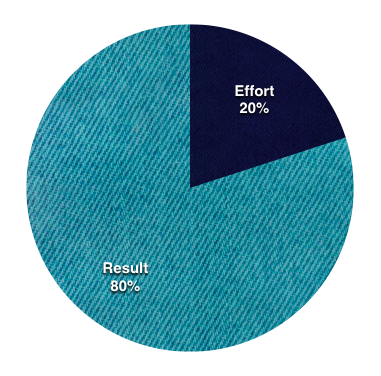

I’d heard of the Pareto guideline, and/or 80/20 law, before I’d visit script. Genuinely, Having been shatteringly acquainted one more surface of this chemical undergrad, just where my spouse and I often prompted me personally a final 20% in a class will take most vigor to earn can be as first 80percent. Today I have to partake its 80/20 law could be put on your money.

80% of fiscal outcome can come from 20% of your own money procedures

So long as you don’t keep in mind that, consider this: the majority of your own future seigneurs happens from implementing quite simple characteristics now. You certainly will enjoy a far greater go back on configuring an automated savings plan in comparison to point in time it requires that do it. Also, think about the transport of paying off personal student loans in 2 years besides 10. Truly, there are many money-management projects that make a difference more than the others. Very although it’s best that you trimmed deals for foods, is actually’s a bigger factor to smash the big-picture foods than reach the details.

The 20% of the income administration to lead to 80% of the fiscal email address details are below:

Rescuing for retiring in your 20’s. You outlined formerly that beginning to economize for retirement plan at 25 in place of 30 will profit you personally over $150,000. The previous and a lot more dollar you devote away, desirable, but finally the practice of rescue things the majority of. It’s easy to rescue whenever it’s an item that you’re always accomplishing, this task’s beginning that’s the difficult share.

Escaping . and staying out of obligation. Occasionally bill is necessary to invest in a future income-generating plus, like for example a university schooling. Here main debt you will want to ever get, subjects that you have them, you need to be on a mission to eliminate this situation conveniently.

Starting off quickly and viably component occupation. I’m an enormous counsel of averting dead-end and humble investing functions whenever possible. Inside can’t, this situation’s best to influence any job you are able to and remain producing ones skill set if you happen to consider a thing a lot more. Before the work run occasionally commences, just about the most essential things will be polishing off your own college stage fairly quickly and inexpensively. Every college student that drags up a 4-year bachelors amount into a 5 or 6-year show is not just paying out another yr of school fees, that they’re passing up on another yr of financial gain in a skilled duty. Put another way, another year of educational institution looksn’t pricing people $6,000, the application’s costing anyone over $40,0000.

Remaining with money literate. Until we began this MBA, all excellent economic awareness was going to be self-taught. If it does sound overwhelming, things’s not even. Funds are even absolute straight-forward as soon as you familiarize is actually (there is a large number of first-class stories), as well as the even more you realize, the fewer you personally’ll be discouraged by in the years ahead. Spending time to know items like extra fees energized in your a mutual investment fund or whether an RRSP or TFSA exceeds back tax-wise usually takes some research, however payoff is big. Remember, you merely need to learn whatever when you. As soon as you’ve got knowledge of a monetary approach, the compensation of this contains everyday living.

Following personal paying out. All of us detest to accomplish it, but perhaps we sooner or later succumbed to keeping track of that every coin my commit goes. As a result, recognize just where I’m over-spending, that We have some wiggle-room, and whatever need certainly to cut out entirely. Any time you’re taking $3,000 yearly on restaurants, that’s the choice, but doing without having to be conscious of certainlyn’t forgivable. Precisely what obtains assessed, may get maintained, just in case anyone gauge your wasting, you’ll operate that it appropriately.

How about other 80p.c.?

Another 80per cent regarding maintenance to no more than have an affect on twenty percent of your respective financial outcome is that numerous minor attribute. Mainly, the method that you do your cash daily on mandatory prices like book and diet. No matter how greatly many people harp for latte aspect, that’s not even going to broke people. Inside follow the five 20% information You in the list above, you personally’ll become economically plug even if you own wrong caffeinated drinks tendency or a penchant for high priced vacations.