I’ve for ages been a self-directed individual. This simply means I’ve in no way used a people to deal with my currency, and as a substitute took the move to educate yourself on the from share so I could go buying and selling. I purchased a firstly provide at the age of 25, and have been connected ever since.

For the majority teenagers, the thought of controlling your investment accounts will be challenging, specially along with juggling another financial responsibilities like student loans or saving up for a down-payment for their 1st house. But still, trading ought to be aspect of your financial suggestions.

Despite anyone might think, you don’t need to have a finance grade or millions firstly within markets, and standing unless you perform may priced at your own dearly.

For you to commit

Truthfully, us can’t manage to pay for definitely not to take a position. Nearly all preservation debts have percentage of interest of just onepercent or a lesser amount of. If you should’re aiming to someday retire with all economical protection, this rates of coming back is unlikely to provide. Towards achieve your budgetary desires, whether or not they live owning a home, banking liberty, or even to manage a Tesla (that’s reinforce), you have to be money be right for you.

And also your currency will continue to work toughest within the stock exchange.

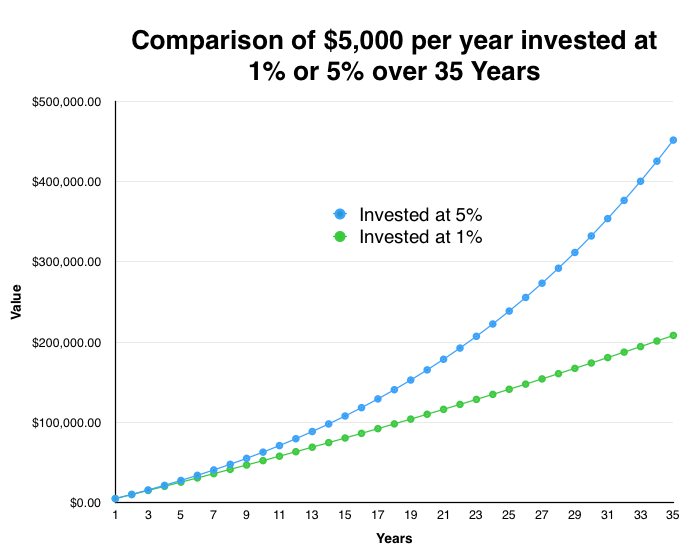

Traditionally, the stock market contains came home a mean of 8.5procent, but we’ll get involved in it as well as take going back of 5%. If you decide to commit $5,000 per year in a savings balance getting going back of just oneper cent plus the currency markets delivering a return of 5%, members’d appear above $240,000 healthier as an investor than a saver after 35 ages.

Why are currently millennials lowering hundreds of thousands of euros by staying out of the stock market?

The reasons why you’re probably not buying nonetheless

A recently available TD study discovered that around one-third (37p.c.) of Millennials express they cannot dedicate at all. Approximately one half (46per cent) mention decreased resources will be preserving them outside of the marketplace, and 40procent convey things’s inadequate economic data. Obviously, should you’re scared with the complexity associated with the stock, members’re one of many.

On top of that, the survey unearthed that 36per cent of Millennials aren’t perhaps sure it’s good time for you to expend, and close to one-fifth (22percent) believe the application’s rarely. Because a lot of millennials ran aged throughout the 2008 financial problem, a number of yet think about the stock game as a risky spot to miss a ton of cash. Handful are aware that, merely contains the currency markets recuperated inside 2008 descend, them’s jumped to all young altitude.

Dread, bafflement, and mistrust are usually horrible excellent reasons to ignore prolonged money security through investment.

Simple tips to beat your concerns and initiate investing

Calvin MacInnis, the adult vp of TD lead making an investment, provided TD’s ABC making an investment manual for serve millennials get started through the stock exchange. I’ve put amount personal recommendation into the ABC step underneath!

Take action now. Don’t allowed decreased capital carry we backward! A large number of young adults usually are shocked to determine ready opened a brokerage balance with as low as $1,000. You personally don’t ought to hold back until you’ve got numerous greenbacks saved up commence investigating the stock market, you can easily (and should!) act right now.

Polish On Fundamental Principles. Should you have dollar to set up business but investment funds awareness is usually stopping you moving forward, there has not ever been a much better time for you to teach. You can discover about shopping for stocks through textbooks, workshops, online courses, and budget furnished by your online business. Programs like TD’s Point Investing WebBroker™ enables wasting simpler than ever, offering numerous changed with newer services, which will make tracking funds more user-friendly and complete. It is possible to sustain investing information and styles through social networks tools like youtube, by using debts like @TD_DirectInvest.

Pick Out A Adventure. I’ve for ages been a recommend of self-directed making an investment, first, because i believe that’s important to remain inside the driver’s chair of one’s monetary forthcoming future, but secondly automobile experience you better. A investment accounts should meditate you are uniqueness as an investor, and start to become created match your expense finish and chance write.

You get amended, and therefore will ones angebot

I’m a much better real estate investor now even than I became 5 years back, and far of excellent buying knowledge originate from learning-by-doing. What’s extra, I’m glad our go when I have. Learning how to dedicate with just a few thousand us dollars ensured we crafted this mistakes on compact deals. Right now excellent accounts will be much heavy, but I’m an even more professional entrepreneur that is an expert on the downs and ups associated with the trade and that can feel comfortable running personal angebot. This may seems horrifying to put your initially $1,000 from inside the industry, but when you consume $10,000 or $100,000, that you’ll be very glad that you performed!

Making an investment, as with additional accomplishment, require process, but it’s worth discovering. It’s really really worth over $240,000!

This upright seemed to be provided by TD. The horizon and feedback indicated on web site, but happen to be solely my own.