In the case of ordering your very first home, the first thing people give full attention to is definitely conserving their particular downpayment. Although this is not even the largest finance weight of title, it is the very first prominent barrier you will need to remove. Working out simple tips to keep a down amount can be challenging.

Before some of us jump in it, i wish to highlight that choosing is very coolheaded. It will certainly sometimes actually provide more money in the long run than ordering. Nonetheless, there is a large number of non-financial things to consider which will make home ownership a target for all. There’s no problem by doing so often. Whether you decide to rip or decide to purchase is usually completely your choice!

When you are tilt towards purchasing over booking, members’re going to have to figure out how to write a down-payment. Here’s exactly why and ways to achieve this task.

How much money are you looking to spare a deposit?

In Ontario, one should inserted over 500 down towards obtain home. Nonetheless, one’re more satisfied savings the greatest money you can pay for. I personally indicate adding at least 10% down if invest in your dream house.

Please conserve varying from $30,000 to $100,000 for a downpayment, programs price of your house.

Usual family terms in Canada is approximately $500,000. People’ll have to keep $50,000 position 10% over. You can opt to spare fewer and get a less expensive location or spend less so that you can much more interest.

A substantial downpayment accomplishes two second big statement:

- Lessens your monthly mortgage payment. The greater you place along at the time you get your house, the significantly less anyone’ll repay general. This lessens to your monthly mortgage repayment.

- Minimises your risk to housing market imbalances. Along the long haul, audience costs mostly ascend, but there’re many years at which they are smooth and even low. The bigger a down payment, more collateral you’ve got in your home straight away. Exactly why that you lower prone to winding up undersea in your home loan.

However, us don’t require to save lots of huge downpayment, neverthelessyou’ll end up being happier if you. The ways stated today will enable you to rescue any total, therefore continue reading!

Exactly how long does it decide to use to write a down payment?

Why easily you may cover the sum you have to get your ideal home hinges the majority on your source of income, as well as training.

Basically, 2 to five years is usually an ordinary timeline to conserve a deposit for property.

But you might need when 8 or perhaps even a to help save a down payment.

The great thing is you may don’t privately have to set-aside every last cent to realize your objective. Owing to curiosity, payouts, and funds reach, at least an important part of your balance should spare by itself. You need to simply be certain that things are in the best source for information. Which means ideal consideration, trades, and tax-shelters that can help balance plant.

Keeping your downpayment in funds vs. assets

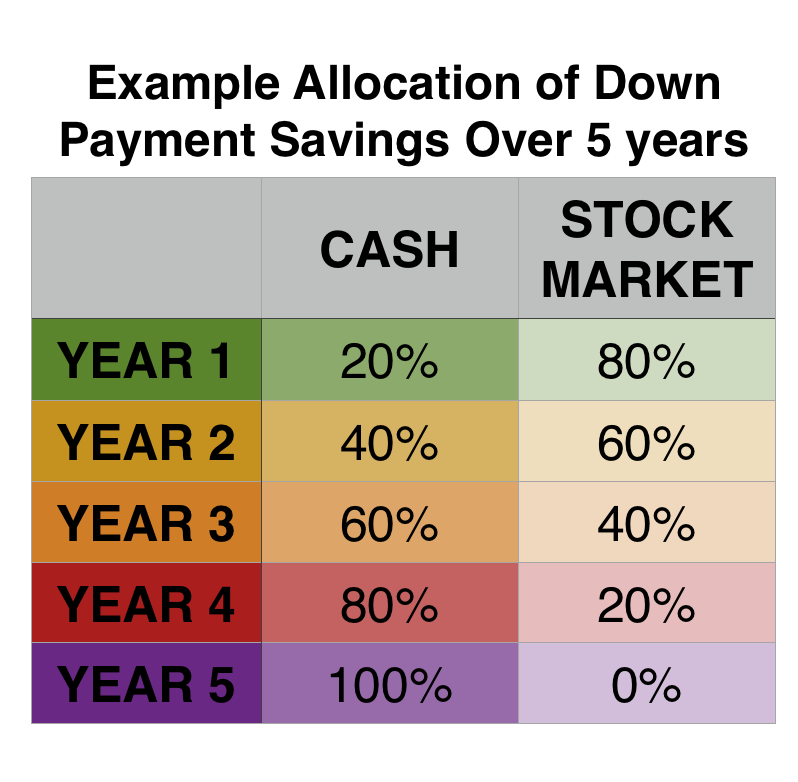

The of your own payments you own in hostile investments (and that I entail shares, in no way Bitcoin) vs. just how much you retain in dollars varies according to your own money schedule. Begin with assertive ventures, and slowly but surely increase bucks placement as you grow nearer to a single day you purchase the initial house.

As an example, let’s mention you personally’re planning to save your downpayment in 5 years. You may elect to commence with 80procent of your revenue dedicated to stocks and 20% in cash in 12 months 1. Gradually, you’ll regularly change this allowance until you have none of wealth used the stock market and them in income by 12 months 5 after you shop for.

I take advantage of Questrade to deal with all excellent purchases. They’ve got super lowest commissions, this means more cash runs to your personal goals much less towards extra fees. You can induce qualified debts with Questrade, and this commonly a area to maintain your RRSP if you’re going to utilize the First-Time base Buyer’s Plan.

You must progressively lessen the likelihood of your own funds unless you’re in an all-cash place once you put a downpayment on your base. The last thing that you want is a stock shop rectification cascade over the times we relax to subscribe your new financial forms.

Simple tips to economize a money in 3 simple

Causeing the a 3-step plan is a little confusing since you can and really should do-all associated with footprint as well. According to where you’re in personal journey, you could have a head start in a couple of among these. Nonetheless, count cutting down your current downpayment a three-pronged process.

1: salvage $25,000 the RRSP

Among the best cost savings vehicles for your own advance payment certainly is the professional retiring Savings Plan (RRSP). This could move dual help store your 1st environment:

- May acquire a tax deduction for resulting in to your RRSP, which means you wage less income taxes throughout the same year or perhaps you collect profits taxation discount any time you charge the assess. This can be used taxation better to help expand enhance down payment money.

- You’ll remove over $25,000 tax-exempt from your own RRSP for a downpayment on your initially location under the newbie Homebuyer’s strategy. You need to payback this cash, but since things’s finance from on your own, one’re only repaying we!

Situation’re element of one or two, possible each withdraw doing $25,000 inside RRSP beneath First-Time Homebuyer’s cover a maximum of $50,000.

The RRSP is definitely a far better spot to economize your downpayment than you are TFSA. Nonetheless is best suited if your money looks beyond ~$50,000. Better your income, the greater the taxing benefit to tucking away from money in an RRSP. You should be keeping at the very least 10% of any net gain for your retirement. If owning a home is part of your own retreat intention, this really is a manner for those resources complete double-duty.

Imperative air: it is important to return the $25,000 your own access from oneself in the beginning Homebuyer’s project. You may have 20 years to repay the total amount, starting out one year after you boost the risk for cash out. Make sure you issue a HBP expenditures into the regular price range as a homeowner!

2: Save $10,000 in hard cash

Hard cash is emperor, particularly when it comes to spending for firstly house. While all of the money in your downpayment will in the end result in dollars, you do want to have some accessible straight from the start. The very first explanation would be that trying to keep a couple of your hard earned dollars out from the markets reduces your threat of dropping everthing. Nonetheless minute is because you will probably find need money on give before you really swallow to your extensive down-payment.

CORRELATED ARTICLES:

- The absolute best High-Interest Money Balances in Ontario

- Some proper High-Interest rescue Accounts & GICs in Ontario

- EQ Bank Inspection: Significant Fascination regarding Clever Saver

- 5 strategies to get the most from personal TFSA

Because shopping a home comes with a host of another reimbursement for example law professionals cost, inspection reports, etcetera. You may need some material profit to pay for these overheads mainly because they muster. Presently, you can generate 2.30percent awareness on your own wealth nest egg with EQ funds, that’s a helluva estimable interest rate for the family downpayment fund!

Conservation $10,000 in capital might seem a frightening task, but a simple way to think about truly to save lots of $1,000 significantly. Need options? Watch:

- Finest make money an Extra $5,000 soon

- Proper The Best $10,000

Step 3: pay the

As soon as your RRSP is that dealt with while’re developing your hard earned money buffer, proceed to invest the remainder of your advance payment at which it can make the highest come back accomplishable: the stock market.

Wasting are a frightening task, but there’s a number of approaches to do it. You could possibly elect to hear ideas on how to place your own self, allowed a roboadvisor do the do the job, or pick a low-fee reciprocal funding. Whatever you decide and decide on, try to get a return with a minimum of 500 on the currency. Retrieve, you currently have a variety of assets the RRSP and $10,000 in bucks, in order to manage to choose a little more chance there!

In relation to keeping a down payment for a house, truly the only issues you really need will be an agenda and moment. With those in plaza, the cash almost saves per se