If you should’re shopping for somewhere to put your money to greatly help this get without the presense of roller-coaster volatility associated with stock game, the options were a high-interest bank account or a GIC.

In europe, people typically imagine the lone banking institutions offered tend to be “The bad 5” but truthfully Canadians have got hundreds of selections — if he or she’re ready net.

Many people are even now cautious about over the internet funds and even though more inclined than far from, these already manage most of their savings on-line. Really, the one and only thing that possibly will take me to an actual deposit part has become cashing our company cheques, but I’ve since launched a US savings site very it could be that’ll constitute planning with the wayside eventually. Anyway, a CDIC-insured on the net deposit will be as risk-free as a brick and mortar some, in addition they commonly extend higher-paying merchandise. If you’re cautious with using an on-line bank, launching a savings history to test out great method to address your own dreads!

Really a high-interest family savings?

Actually, there are cost savings records that settle 0procent stake. That’s pathetic, for the reason that it will in reality lead to a bad rescue number as inflation generates your hard earned money value progressively a reduced amount of as time passes. A high-interest family savings has become a savings account that do not only is advantageous us fascination, but complies with you enough attraction your dollars will actually produce over time.

Finance institutions will provide you with a myriad of diverse interest levels on bill, but since one’re looking a family savings you actually want to consider this pace over 1procent. Conscious, a 1per cent homecoming will never be gorgeous, but here is the reality we all live-in presently while the wonderful is certainly members’ll be able to find more than that.

Once in a while finance institutions will more than publicity percentage of interest over 2per cent, and so check the print when you see these data assuming that’s only for a restricted set or on some scales or specified records. Often you actually can find a diamond through the bumpy, but every now and then circumstances are too good to be real.

What’s an assured investment funds record (GIC)?

A Guaranteed expense certification or GIC is a wonderful savings tool if you are regimented to keeping your hands-off finances for a confined period of time.

As soon as you decide to buy a GIC, one’re sure a high-interest amount should you pass your hard earned dollars raised for a phrase, starting between 1 month to 5 years. Mostly, the much longer the term, the larger the rate of interest. Non-redeemable GICs will not let you take your money up early — you must await the whole phrase. Redeemable GICs will let you get the members invested before the phrase is up, however forfeit the higher ir and definately will arrive 0.5percent if not 0procent on your investment.

CORRELATED: Wherefore Your Own Savings Program Really Needs GICs

A GICs is also a great super-safe investment funds for long-run financial savings. If you have a monetary challenge that may elevates 2 period of time to truly save for, or you like to devote cash for retiring, this can be one of the best vehicles consider!

Boost our reductions by placing it in a Tax-Free checking account (TFSA) or certified pension Savings Plan (RRSP)

At the time you’re bringing in a return individual payments, the last thing you’re looking for constantly reduce things to taxation. Which is why you must shield our financial savings in a Tax-Free checking account (TFSA) or Registered retirement plan Savings Plan. Ultimately, anyone’re with such duty shelters find, so you’re able to make money superior homecoming on your currency tax-exempt or tax-deferred, but that shouldn’t imply never have bucks under these umbrellas.

Most people need a TFSA, and most people should have an RRSP. Any time you’re uncertain which to pick on your own, have a look at your postings:

- The TFSA versus The RRSP

- Do you need to benefit an RRSP or a TFSA?

- ONLINE VIDEO: The TFSA Said in three full minutes

- PICTURE: The RRSP Explained in three full minutes

Several array have large pace on TFSAs and RRSPs, so that double-check the interest premiums We have down the page to ascertain if these’re advertising novel for registered debts.

Finding a cover

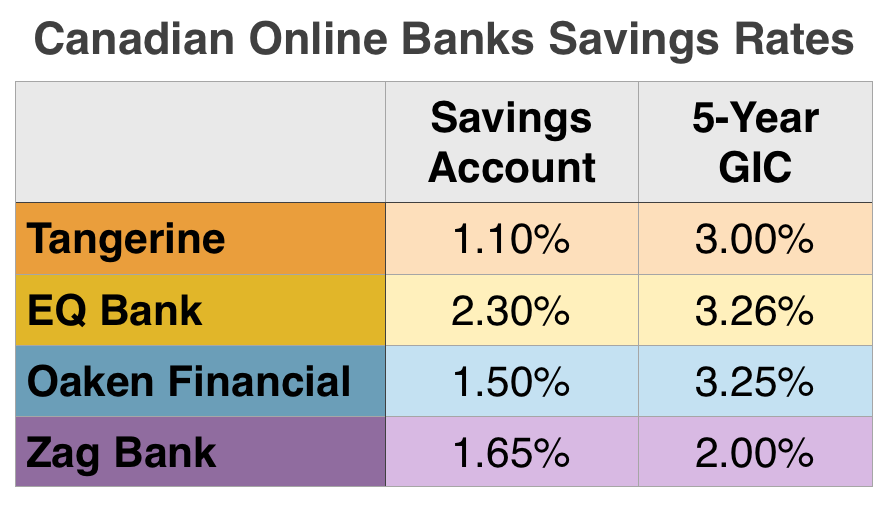

To cut to the follow, in this case’s a directory of the latest high-interest family savings apr and 5-year GIC fees

Read on for a much more precise reason of the tip directly below!

Tangerine – tangerine.ca

- High-Interest Family Savings Pace 1.10per cent

- 5-Year GIC Price 3.00p.c.

Tangerine may my primary lender for pretty much a decade, and I do not have any wants to change over any time soon. Not only can they furnish you may high-interest nest egg accounts, you could pull in awareness on your own chequing accounting. Tangerine has operated by Scotiabank, which means you have access to income at Scotiabank ATMs. Skin Tangerine Cafés in many of Canada’s great places, where you could come in and relate direct with a Tangerine advocate and they’ll support many internet savings desires. This makes Tangerine a great banking remedy for all cautious with converting to web based monetary.

EQ Reserve – eqbank.ca

- EQ Tip Discounts Asset Account price 2.30per cent*

- 5-Year GIC Pace 3.26procent

You only recently got customers of EQ ridge, so we’re all the same in getaway period but we this could be true love. A high-interest savings account fee can’t end up being survived, and their support has become topnotch. You change dollar into this EQ bank account from a Tangerine chequing information, and I really like i commencement making attention to my payments when My begin the switch, not likely following the algunos business days it requires to really place the income in my profit. EQ tip is very on line, this means you should feel comfortable concealing your money with an institution that you won’t capability take on a branch or business office for IRL real human guide.

Oaken Budgeting – oaken.com

- High-Interest Bank Account Value 1.50per cent

- 5-Year GIC Rank 3.25per cent

I no own banking exposure to Oaken finance, but My spouse and I wander by their branch in down the streets Calgary commonly. Like Tangerine, this can be perfect middle soil when you need the online consumer banking undergo, but nonetheless on your choice to talk to a genuine human face-to-face if you’d like. Oaken economical will be a hidden diamond with percentage of interest. No 1 indexes these individuals, but they offer up outstanding lending options!

Zag Lender – zagbank.ca

- High-Interest Family Savings Fee 1.65percent

- 5-Year GIC Rates 2.00%

Zag cover is one other ridge regarding however to experience average joe, nevertheless they’re gaining lots of traction because I’m needs to visualize themselves everywhere. While a 5-year GIC level is actually underwhelming, its savings account apr can be more competitve aided by the another ridge I’ve posted. Like EQ act, you’ll need to be gentle trying all totally on-line, nevertheless for that everyday monthly interest, this task’s really worth the cost.

If you’re picking out a ridge, don’t definitely follow precisely the rate of interest! It’s crucial that you just like your lender but you line up your hard earned money easy to access and operate, then study a few different versions prior to deciding where you need to keep the wealth. Besides, the situation’s crucial retrieve that you don’t require go for one! Completely different banking institutions and various types savings account could possibly be well for many different objectives. My favorite latest delegate throughout the 5 Bank Accounts every body desires might provide ideas of best places to restrain which savings in which!

Joyful preservation!