Selecting the right house & auto insurance can don’t be a product that was easy, now genuinely. Indeed, it is possible to make your reporting on line.

Insurance policy is one particular things ought to get but we do hope you never need to employ. In the event you use all of your insurance plans, it is meaning something chose incorrect. Home appeared to be robbed or stressed or you had an auto accident. Since these are really stressed life incidents themselves, possessing appropriate policy can trim in addition you having to deal with personal focus too. That is why deciding on the best location & car insurance policy falls under your management needed.

Saving a financial assets will be as significant as attaining him or her. There’s no point saving for a residence or an automobile or something any time you’re not really likely to care for the situation. Insurance coverage is the way you make fully sure you get to keep whatever you’ve toiled difficult for — inside the face area of the unanticipated.

As your everyday living adjustments, the insurance coverage coverage you will need can do also

I got myself my very own initial van this past june. My think the “first car” since it is the first vehicle I’ve ordered and bought absolutely ourselves. The majority of my personal 20’s ended up devoted depending on neighborhood roll and my own two paws. The long time i did so personal a vehicle, completely possibly a parental cast-off or featured. Finally I finally consume my very own van, exactly where me the only driver on the insurance premium.

Additionally, with my rapid 20’s my spouse and I lived in shadier studios or houses with a lot of roommates. Our normally bought by without renter insurance premium. Totally small for time: I held just a bed many shirts. Even though a thing disastrous taken place i had to change out all, the application probably wouldn’t own cost more than some thousand pounds. The plus of renter coverage, even though you don’t own plenty, is that if anything happens like the water surge and you may not survive right there, to your expenses like lodge charges may taken care of until resort can be achieved. Aside from that it comprises of liability insurance policy should someone sue one for a product that occured at your residence.

As I got previous, generated more funds, and purchase nicer matter, protecting everything I operated started to consequence. Additionally, nearly all landlords finally required proof insurance plan consider could charter their home.

Two things genuinely went your requirement of amended renter policy: a infant and organization.

I inspired from a one-bedroom to two-bedroom condo as soon as I acquired my favorite kid, and amount of things I held appeared to increase greatly. In case there is a fire, flood, or stealing, not simply the properties will have to changed — my favorite small’s fill would need to take, too! Should’re parents, you already know the high cost for a stroller or a crib. You will not want to acquire those things another period of time!

One item appeared to be my business got escalating almost as fast as your minor. Since I suffice lots of home-based, my more costly gear for organization was basically retained here instead my favorite workplace. I two personal computers and a DSLR cameras, amongst second equipment, that must save. Make sure that your organization expenditures will be taken care of under your family guidelines (otherwise experience a different coverage). Physical base guidelines can incorporate a lot of insurance coverage for work from home business payments, you need simply how much.

Determining variety of place & auto insurance coverage want

Many people, myself required, are inferior at determining what amount of insurance coverage they are required.

We both generally “forget” you purchase still the best most nostalgic and crucial treasures, like jewellery or skill. Situation desire a warning as to how very much your current “life” costs, consume twenty minutes record and estimating the cost of everything you could hold within one living space. Anyone’d be surprised how quick the sum total produces a number of thousand greenbacks.

Fortunately, we don’t require itemize and approximate the cost of every point at home discover correct policy. Your individual items insurance policy will may include $30,000 to $100,000, so you cognize better than anybody which destruction of these variety fulfils your personal property!

When considering your car or truck, upon policy that you’ll require is based on both about what anyone thrust plus have the situation. Longer daily change in an extra rv will definitely cost much more to protect than a beater you simply usage on sundays. Furthermore, using your machine for function or a side hustle and bustle like Uber, or telling this situation with another operator can likewise feeling a insurance prices.

You’re getting some adaptability in enjoy such things as to your risk limitation, you are deductible, and you would like excess just like the cost of accommodations family car dealt with if you happen to require one in the event of a hit. You may assess if you only may want automobile accident insurance coverage, or you would also like motor insurance for things like decreasing stuff, call, or theft. What sort of insurance coverage is just the right fit for people hinges on your residence your particular financeand how much cash you love your car or truck.

Knowledge personal insurance coverage

one in 3 Canadians never have study house insurance policy. And until a few weeks ago, Having been one too.

Before we go through excellent detailed vehicle insurance quote, experienced a loose notion what most than it said. Like 90percent of Canadians, you known common quantity like “deductible”. I simply regular learned to go for a better allowable in order to minimize my own once a month insurance!

But another condition, like complete insurance coverage, was far less perfect. Detailed insurance premiums insure the car against damage other than that from a collision and comprises of issues safety against decreasing or soaring devices and vandalism. You could be both super-safe and super-lucky not enter into a major accident while travelling, but that shouldn’t represent a tree won’t fail on the truck when you’re stationery out on the road one time.

If you want to determine’s insured by your home or car insurance policy procedure, read this glossary of policy keywords to better realize what each word suggests.

What’s paid for and ways in which a great deal of it costs to do this can have a great deal to manage with where you happen to live. Our spent bigger occupant insurance anytime I live on a leading hall condominium than used to do right after I followed on a diminished floor. Even price of a car insurance modified as soon as I relocated to a new location! Take time to study your own policy to appreciate exactly what’s lined, precisely why, and by just how much to ensure that that you have information you need.

Bundling residence & vehicle insurance to save cash

Together with each other, my resident insurance and car insurance policy exclusively amount myself to $120 on a monthly basis or maybe just not $1,500 annually. It’s still a substantial program, but because both are crucial expenses, the thing i could really do is certainly attempt to get the very best share likely. Many of us don’t worth browse when considering insurance premiums, so I was ever responsible for this at the same time. Searching for policy music unexciting, mind-numbing, and intricate. Although it doesn’t have to be.

Poem has both individual car insurance policy and private home insurance. These are typically Canada’s foremost entirely on the internet environment and insurer. You can aquire guaranteed in minutes without previously posting the pleasure of your respective chair. You already know whatever you’re investing because of your ongoing insurance firm. At this point have your estimate from verse discover how they do a comparison of.

Deciding on the best location & car insurance policy

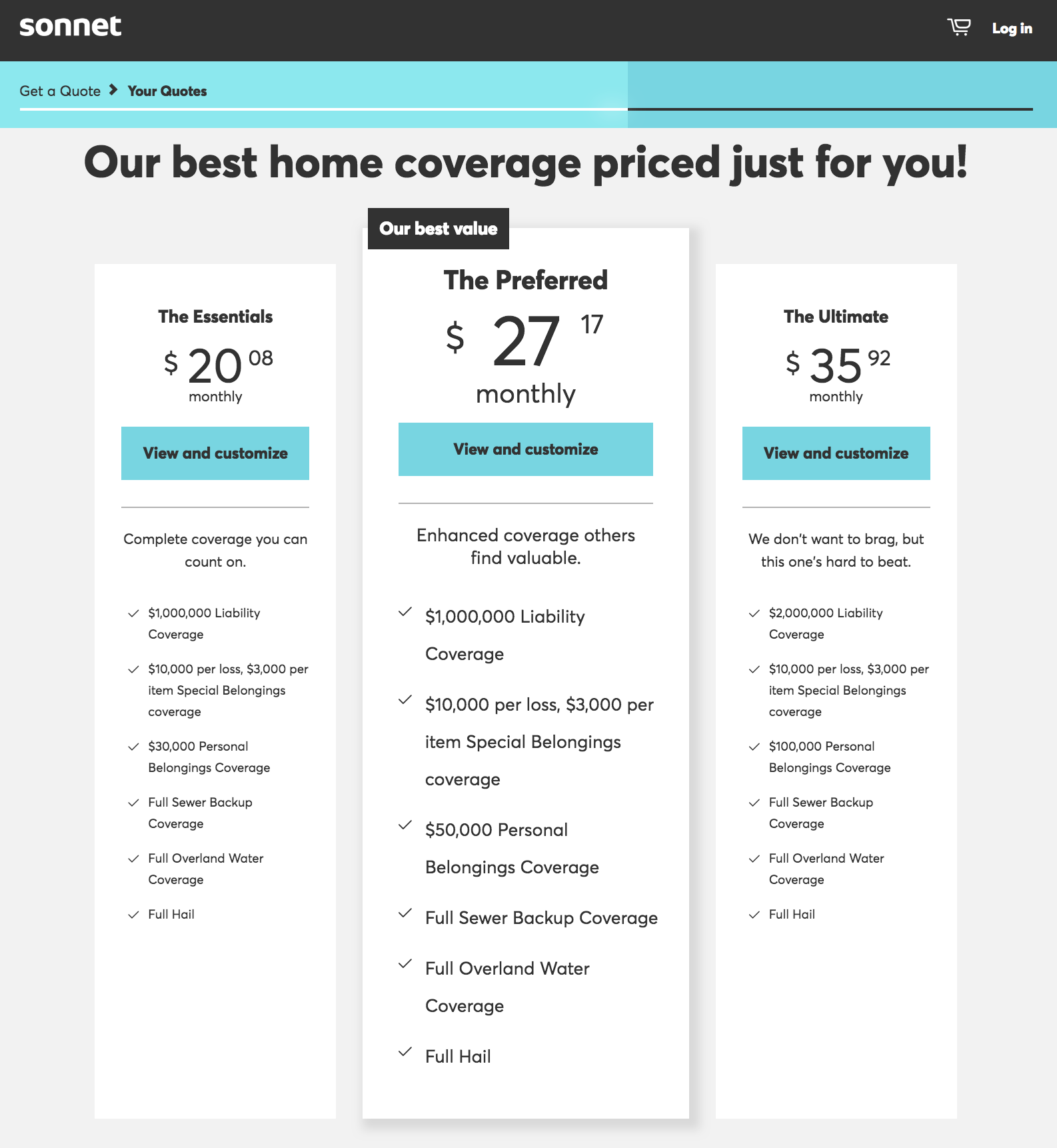

Praise will don’t alone form insurance plan very easy to shop for, they create it easier to appreciate. As a substitute to difficult insurance protection vocabulary, you may’ll get light code throughout Sonnet’s blog and insurance policy papers. What’s superior, they choose info generate coverage that’s accurately for your family. I managed to get a cite AND insurance within minutes.

Yes, us read that best. Policy AND insurance. My spouse and I didn’t send in all the information right after which loose time waiting for anyone to call me to let myself to know my very own destiny. With praise, you can find out the interior and auto insurance costs and set large abruptly. Gaining well guaranteed hasn’t been easier — so now you don’t have any alibi!

This post was sponsored by Sonnet, but all views belief conveyed herein will be the.