There are a few good poles now on particular money. Our in particular really like Michelle’s record I’ll never be a frugal tumblr (*fist bump*) basically because, fin understands that, my spouse and I won’t choose to. I’ve much already been tagged the “YOLO blogger” because i a tendency to spend cash quickly, excessively, along with some sort of jubilation that sends worry with your normal frugalista’s core. I will be courageous though, because It’s my opinion funds are something to enjoy yourself.

Now, the method that you love life (and the way a great deal) is up to members. People rate different things to many levels, that is why is actually’s ok to sound a net cash flow on marshmallow solution in the event it’s making you personally contented. Like all attribute, moderation is key, and drastic frugality can make you since unhappy as paying until you’re shattered and in-debt.

Now this:

[youtube http://www.youtube.com/watch?v=z5Otla5157c]

Simply would be that a skillfully rib tickling funny video footage having a husband to be, Adam Levine, additionally it furnishes fantastic, especially frank information implementing both media and sarcasm, that’s the best means of thinking nearly anything. They certainly do include some comment on finance arranging if you want to skim before to 2:00, or perhaps investigate verse below:

Read no probabilities, end freelancing currently,

use your future, don’t dilute finances, 401K, potassium?

guarantee this’s lower hazard, and then find some real estate

How much? 4.2per cent, 30 day loan, that’s significant, that’s much!

if you possibly could have enough money for them, don’t get the situation, knowing remaining advertise

booking is good for suckers presently

hold trusted savings and also you’ll fire with money into your story

YOLO? Say bad idea, get who you are and simply tumble unicamente, be careful-o

All of those other video recording always renders people LOL at several not likely to obnoxious irons or live shows to not travelling, which you know, are pursuits that occupy the majority of this leisure time. One of the best aspects of getting cash is expending that it, and so I don’t essentially let why any individual would decide to provide in cool water or maybe not purchase order alcohol with a meal to retain the expenses off. Folks have plenty of good reasons for definitely not trying amazing matter, and there’s a good number these causes inside the confidential loan profession although cliche holds true: own fund will be personal.

THAT FRONT! <3

Every single person should wealth in a different way, and I opine in an ideal reality every preachy PF journalist would rather anyone to spend cash the way they create, because anyone feels individuals’re doing it “right”. Personally I think the actual estimate of whether or not you may’re carrying it out properly is fairly very simple:

will probably be your total worth raising each and every month?

Detail response is not, you may’re executing it amiss.

Should response is obviously, you may’re performing it right.

How much you’ll want to “do best” is perfectly up to members, be it $50 or $5000 there’s genuinely no improper resolution. You may live on Kraft an evening meal and trust every expendable money, or maybe not. You can actually lower your financial situation with exactly the least fees and also be in debt for many years and decades, or maybe not. There exists a pleasant environment from the opposites, nevertheless’s to define. Directly situation’re here interested in recommendation I would in addition persuade one:

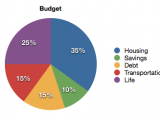

- start saving money ten percent of your respective revenue for retirement

- establish an emergency budget that replenish 3 many months of any money

- redeem

high-interestall liabilities - get income-generating possession

- earn as much cash as is possible

But that’s just i. Every option two gains and risks, might be prepared to accept essence of your preference. (Note: other people might not be in a position to accept the consequences that you pick, and will be oral about any of it.)

I think lots of readers shopping individual money weblogs don’t should call it quits at 35. Just need to be in a significantly better financial position than people presently find themselves in. Probably somewhat less unsecured debt, extra cost savings, more peace.

A lot of people wish to have income for money’s sake, a lot of people want income for any chosen lifestyle, us don’t occasionally want cash at all, they discover it is an important wicked that they need to implement towards manage to pay for things like goods and rent. However you serve wealth, just be sure personal the main thing heading to be up and her performing elizabeth fee you wish that it to. No body needs to endure finances but you, you may get to have the regulations. But in addition, it mean situation’re not happy with where you are, you must be responsible for the and alter your circumstance.

If however members’re much like me and you’re confident really dollars as well as how devote this situation, so go on, friend, go on — simply because you entirely be when you.