A short while ago, I tried to purchase an espresso before a substitute within my part-time retail outlet career, and my personal TD bank card had been denied. One or two minutes later on, my spouse and I obtained a telephone call from my own funds questioning easily wore recently prepared a withdrawal from an ATM for $300 – on the other side of the nation. Since I hadn’t flown from MTL to Edmonton from the rush of complete early that dawn, it had been obvious the money drawback was evern’t my own. Our information was copied!

The charge menu was ever straight away terminated and $300 appeared to be returned to our explanation, but I experienced to stick around a few days for excellent new to debit cardboard and fall to-arrive morning. I’m undecided why or just where my own account information got destroyed, but that was the first occasion I was the prey of identity fraud.

Con writers and singers make use of a myriad of ways to consider collect individual data files, from skimming money and credit card bills to “phishing” for your specific facts straight from anyone. Being aware of what different approaches information criminals use might help maintain everyone savings.

Three of the types of “ishing” kinds sensitive information

Smishing

Essentially the almost all prevailing sorts of “ishing” specifically impacting myself currently,. Every few days our apparently become a text idea inviting personal information or incorporating a website link to a website. The ones I’ve got induce generally believed I’ve received any value, without expressing the things competition my got into, or say I’ve previously been chose as a mystery person. I simply certainly not click on the particular link throughout these communications, and also prohibit the quantity before deleting the written text from this smartphone so they can’t send me a email just as before. Smishing scams will often ask for a credit ratings or money see number, ones hell, or additional information that is personal.

Want be cautious about: Smishing texts normally have punctuational or grammatical errors and overuse punctuation, some thing a seasoned trust could not manage. Likewise, should you not realize the number or perhaps the offering, this’s better to disregard the note and prohibit the amount in no time.

Phishing

Phishing involves authentic-looking emails “fishing” private facts. They will often require closely inside web mail for you yourself to reply with log into it tips or PINs, or they aim anyone to an online site kind expecting the same susceptible info. You must never react to these e-mails with any sensitive information, or enter information on any webpage or variant then they links.

What you ought to be cautious about: look into the transmitter email to find out if them’s identical the from where you may generally acquire e-mail the trust. In case’s far from, remove the e-mail now. Phishing cons can submit official looking for e-mails from counterfeit address, intending people won’t be that tightly. Another heavy concept an email is certainly a phishing fraud is actually if things’s requesting for a go browsing facts at a bank anyone don’t contain records with! Please do not answer with any sensitive information. Edit the email and forget the sender.

Vishing

Vishing is unwanted telephone calls wanting to know direct kinds details, or to follow-up on a phishing netmail you may have acquired. Occasionally these enquiries are carried out by an actual man or women, but usually genuinely a recording asking into careful info such as your failure or visa or mastercard figure.

Things to be aware of: If you should experience a phone call seeking private information, or pushing you to respond to or pursue the link in a distrustful message, say goodbye. Once in a while these customers and prospects will explain to you easily’ve received a competition and after this need to have your personal files to help you accumulate the award. If you decide to don’t bear in mind joining any sweepstakes, this task’s probably a scam.

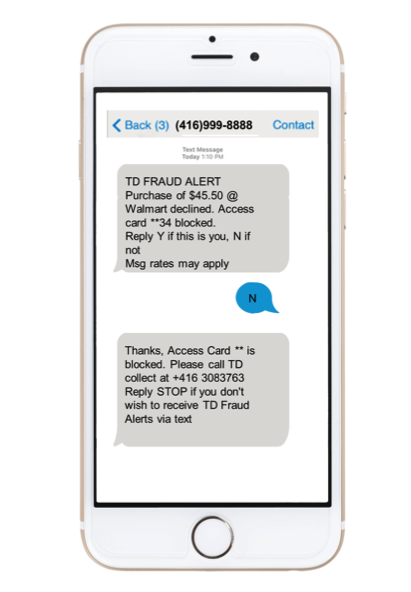

TD Crime Notifies

To help keep your facts and money fail-safe, TD has got started another function that sends Canadians a free[1] deception attentive sms if there is distrustful behavior diagnosed on their own TD entrance paper for his or her physical banks and loans profiles. Users can react to the written text with “Y” or “N” to verify when they recognize the business deal and get TD unblock a tease.

TD can never question clients to respond to a scam mindful text with any information that is personal or consult clients to visit any web links inside their answer. Go ahead and don’t forget about to make sure TD offers your present airborne host for these warnings.

Furthermore, the TD MySpend iphone app will restrain TD clients alert to expenses on the records, through real-time notices. May enable you to spot bogus products the instant that they encounter.

Alternative methods to guard You Against Theft

During the vacations after you’re shopping for things for family, this situation’s simple to fail just how much you personally contributed and where – therefore you too is less likely to detect a fraudulent procedure individual trust remarks.

There are some ways you may establish identity fraud:

- Quiz funds record and online actions regarding ventures us don’t spot. Keep our bills via grocery tours in order to liken and identify any dealings that aren’t yours.

- If you decide to accept debit card records and other fees portion call which do not participate in you may, it could possibly indicate someone is using your facts to start credit history history portion identity.

- If a lender tells you of a loan application for trust gotten using your address and name, however you did not full.

- Any time you put in iformation your trust account with a buyer stating agency become alerted before recognition looks longer, and also you have a notice a assets would be longer therefore didn’t sign up for this.

If any associated with given above appear, that it’s vital that you contact your mortgage company nowand the credit coverage agencies. Quicker you understand and complain any fraud individual accounts, the better. Discuss with your bank how to decrease the harm and prevent any further crime – that comprise concluding bank account and reading brand new ones, swapping cards and assigning newfangled hooks, and shifting found deposit references.

Sad to say, there’s absolutely no tried and true method to maintain yourself from scam or identity theft, however important information around shall help you eliminate the hazard. The concept of identity theft is fast moving and changing fast, as a result it’s excellent you keep up as of yet for ways to spot and minimize scam to be able to good safeguard all by yourself and also your funding!

This announce might provided by TD ridge, but all view are generally my own personal.

[1] TD cannot commit any prices for TD scams warnings. However, usual wireless provider note premiums may relate.