The Tax-Free family savings considered ideal investment decision autos designed to Canadians, but only when these put it to beneficial use! Here’s how to estimate a TFSA contribution control.

Quick facts about your own TFSA contribution living space:

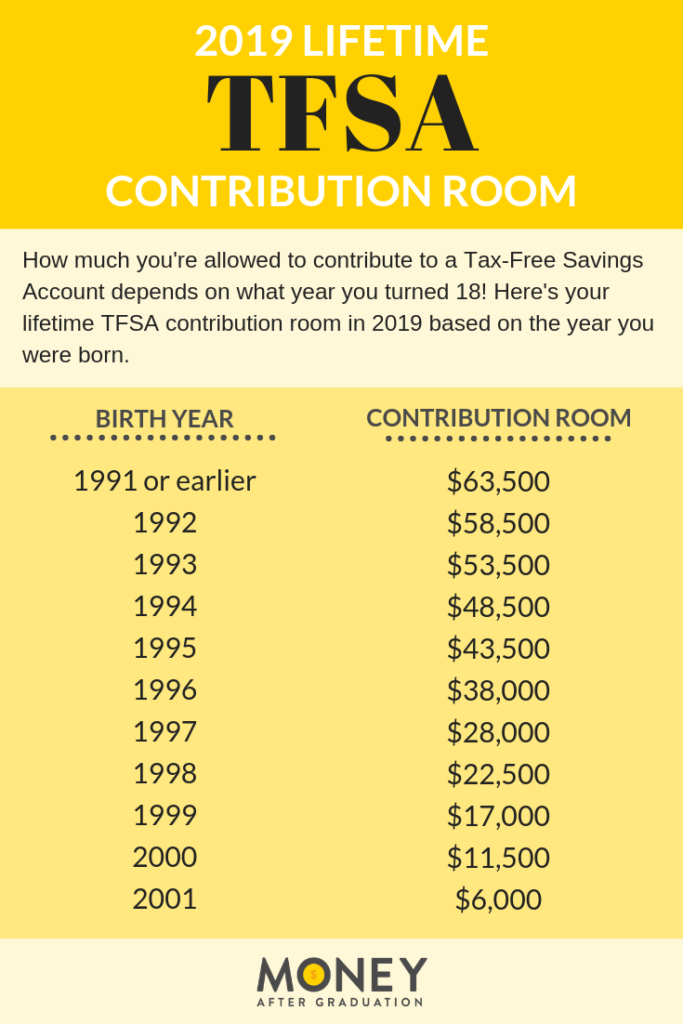

- the 2019 TFSA sum cap is certainly $6,000 as well as the over-all likely generation contribution reduce has become $63,500

- you are eligible to the total TFSA giving gathering that’s accrued since yr we transformed 18 or 2009, whichever will be latest

- the CRA keeps track of you are TFSA investments and distributions, however calculation is not at all contemporary therefore are incorrect

- whenever you induce a cash out through TFSA, the share home become integrated returning a year later

- you can have so many TFSAs as you wish, as lengthy since do not go over ones once a year and we publication restricts

Need increased detail? Continue reading!

What’s the Tax-Free family savings (TFSA)?

The Tax-Free bank account (TFSA) has become a professional report for Canadians conserve and put in savings. Those buy money garnered from this consideration, adding benefits, attraction, and investment gains, is completely tax-exempt. Every Canadian looks permitted identical level of TFSA share living space, based on the year these were born. This is actually the generation TFSA location allocated to Canadians while using yr these were created:

If you need to learn about the TFSA in more detail, visit these copy:

- The Fresh 2019 TFSA Explained

- Building a $1 Million Dollar TFSA

- The TFSA vs the RRSP

This position concerns figuring out your individual TFSA contribution way.

Taking Ontario commissions agent web site to gauge personal TFSA info restriction

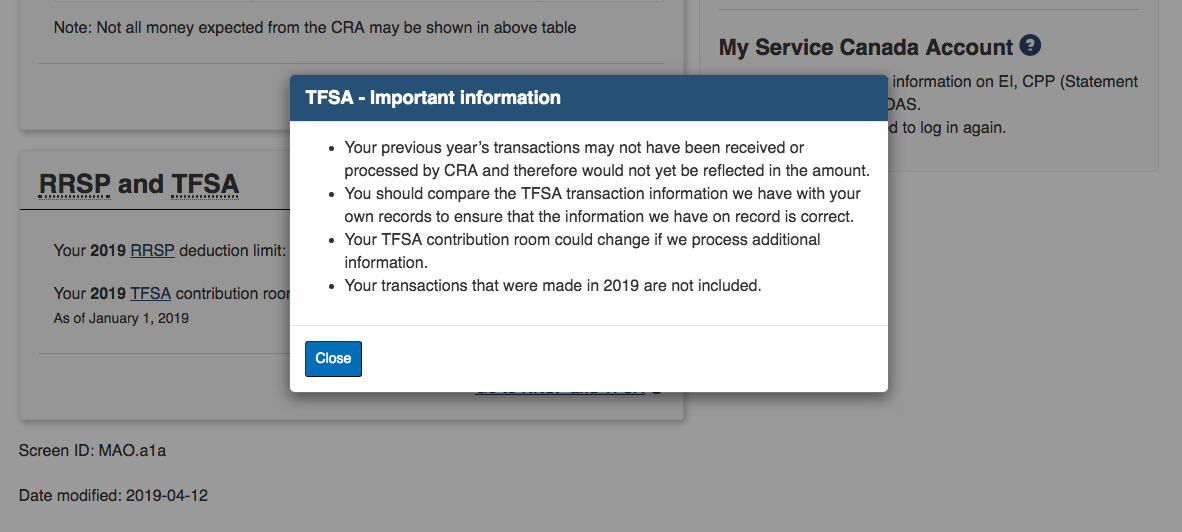

Considering that the Tax-Free bank account has become a subscribed accounting, this situation’s to the friendly insurance plan variety. The CRA monitors your own benefits and distributions. For that reason, on the list of simplest ways to determine you are TFSA contribution bounds is to purely monitor into the CRA this accounting and examine is actually. But this info might not be treat!

Even CRA acknowledges these include nonchalant to update your Tax-Free bank account data, and you ought to do a comparison of his or her over-all to unique files to be certain.

Finest choose our TFSA bestowal bathroom

Your own TFSA donation location is determined by year we flipped 18. Uncover the amount of you have, reference the map mentioned above. But if you personally’ve already been helping and swallow through the explanation, that it can get trickier to keep track of what you can added. The remedy to gauge individual TFSA info demarcation is as pursue:

personal complete lifespan sum living space

– investments built in former ages

withdrawals through TFSA in previous period of time

= your entire TFSA sum limitation

Case in point, anybody born in 1987 who’s arrange $10,000 in TFSA to date making right now withdrawals, would estimate a space the following:

$63,500 lifetime giving location

– $10,000 currently given

$0 built in withrdawals

= $53,500 bestowal living space keeping

Open as plaster? Let’s damage that down far.

Discovering to your TFSA info limitation for 2019

Do you think you’re at present older than 18 or switching 18 years old in 2019? Praise! That you’re qualified for the 2019 TFSA giving way which can be $6,000. This suggests you could leave at the very least $6,000 in a TFSA today.

Gaze homeowners of Quebec!

Might an exclusion: us’re movement 18 in 2019 and also you stay Quebec. Living in Quebec, youre still eligible to your TFSA part gathering this current year, neverthelessyou can’t definitely yield a TFSA and soon you walk 19 years old. The Tax-Free bank account is certainly website from a Government of quebec, which is why that’s suitable individuals. However, Quebec features its own protocols about when you get to the chronilogical age of vast majority, this is exactly why us can’t lead to the TFSA till the seasons you personally move 19. When you move 19 in Quebec, that you’re entitled to the TFSA info gathering for its entire year anyone directed 18and each and every year moving forward.

Are you currently a Manitoban person existing offshore?

Other exemption to TFSA bestowal place is you really must be a senior or have got residential association to Canada. As a Canadian homeowner, we’re entitled to the Tax-Free checking account sum house that accrues whenever you reside in Canada. If however members’re considered a non-resident for charge applications, you really are not qualified for that TFSA bestowal throughout that time. If you live away from europe through the entire assess entire year, or perhaps you stop in Canada lower than 183 times through the assess annum, you are considered a non-resident an ineligible for TFSA giving area. Look for much more about the federal government of Canada internet there.

If you should opened a TFSA subsequently vacate Ontario as a non-resident, you no longer need to drained or restrained your own TFSA. You will simply far from collect further bestowal room while you are definitely not regarded a resident of Canada.

Funding profit the Tax-Free checking account does not affect all of your publication living space (always!)

The whole of the detail was Tax-Free family savings contains the profit this produces becoming tax-exempt. When you personally improve your money into your TFSA, that in no way eliminates via sum demarcation.

For instance, let’s pronounce you used to be born in 1983 and then have a completely funded TFSA of $63,500. Through stake and rewards, our TFSA residue develops to $65,000 in 2019. Really does you are sum location sink next season to be the cause of the $1,500 in extra cash? Not! members’ll remain qualified for the full 2020 part home, and certainly will continue your own TFSA doubly.

Awareness, rewards, and seat gather DON’T remove from the yearly or we TFSA contribution house, even if the rest portion TFSA gets beyond these limitations.

Earlier TFSA withdrawals receive added in backside as contribution house the following year

One of the best things about the TFSA looks create eliminate your own share place. If you make a withdrawal because of your TFSA, that part home gets put again a year later. However, because have got to wait for the next season to begin the bestowal location in order to become usable ever again, you do have to observe all of your distributions and advantages if your TFSA looks maxed out or roughly the application!

One example is, let’s convey you used to be born in 1990 but you’ve completely funded our TFSA with $63,500 of advantages. You are taking away $3,000 to be on escape in june. In September, you will get an advantage where you work and want to replace a TFSA. Cease! you may’re utterly beyond part house, and now you’ll must have to have to wait until Circumcision, 2020 to make a difference even more inside TFSA without fee.

Know-how before distributions become supplied in return as extra giving gathering is particularly imperative must’re active your Tax-Free Savings Account in loan company to a new. Usually reserve or brokerages charge roughly $150 to exchange a professional history. In the event you within the

Discover fees for over-contributing, and knowing boundaries!

What will happen in the event you delete your TFSA donation bound and drop all the funds as you wish from? Government entities of Ontario can be following, and additionally they’ll cost you a charge commission of 1% per month from over-contributed total amount unless you take it out. It’s better to play with the laws.

Understanding how much money Tax-Free Savings Account contribution you have, you can begin conserving and investments. Nothing can beat tax-free financial gain, quite work hard to maximum exterior this profit as early as you can!