Because already have noticed, not long ago i ruined our credit. Having been implementing Borrowell to keep track of this completely free, and after three months of it heading down, At long last looked decide the thing that was trying.

Luckily, several around 150 things to my personal credit score was ever because a little error that was preset even more quickly than it simply happened. Especially those many weeks which ascertain the application nosedive up a cliff, you had some INTENSE economic focus.

Learn status? Ask for all of your free of charge fico & credit history from Borrowell HERE!

That our number is certainly preset, i’ll rest easy… and don’t crack a monthly without investigating them ever again.

What makes your credit rating very important?

Your credit history appears a risk appraisal of how beneficial you’re at dealing obligation.

Banking institutions utilize it to ascertain inside’re likely to be a client that will pay it well or perhaps not. Negative account pin one equally high risk, implying that you could not trusted for paying out a expenditures outright or regularly, whereas estimable score recognise one as deep liability and report that you personally’re very likely to get together with your financial responsibilities whenever they’re expected.

The bizarre part is also, the debt anyone hold, a lot more likely you may be having a very good overall credit score, despite the fact that do not have funds left-over developing establish your least costs on all. Alternatively, you can actually shun credit debt and reside very fiscally reliably if you are paying merely bucks for all of it, as well as your overall credit score are going to be negative.

Anyone don’t really need to take either condition. Whatever you want constantly feature extraordinary finance behaviors AND a good overall credit score — and it also’s totally possible.

Check your credit history

That you can’t enhance credit score in the event you’re instead of monitoring is actually. Fortunately, you’ll receive both your credit rating plus full credit report free of charge from Borrowell, the internet site I’m taking to trace mine. This really is thought a “soft affect” on your own credit file, so it doesn’t hinder the success!

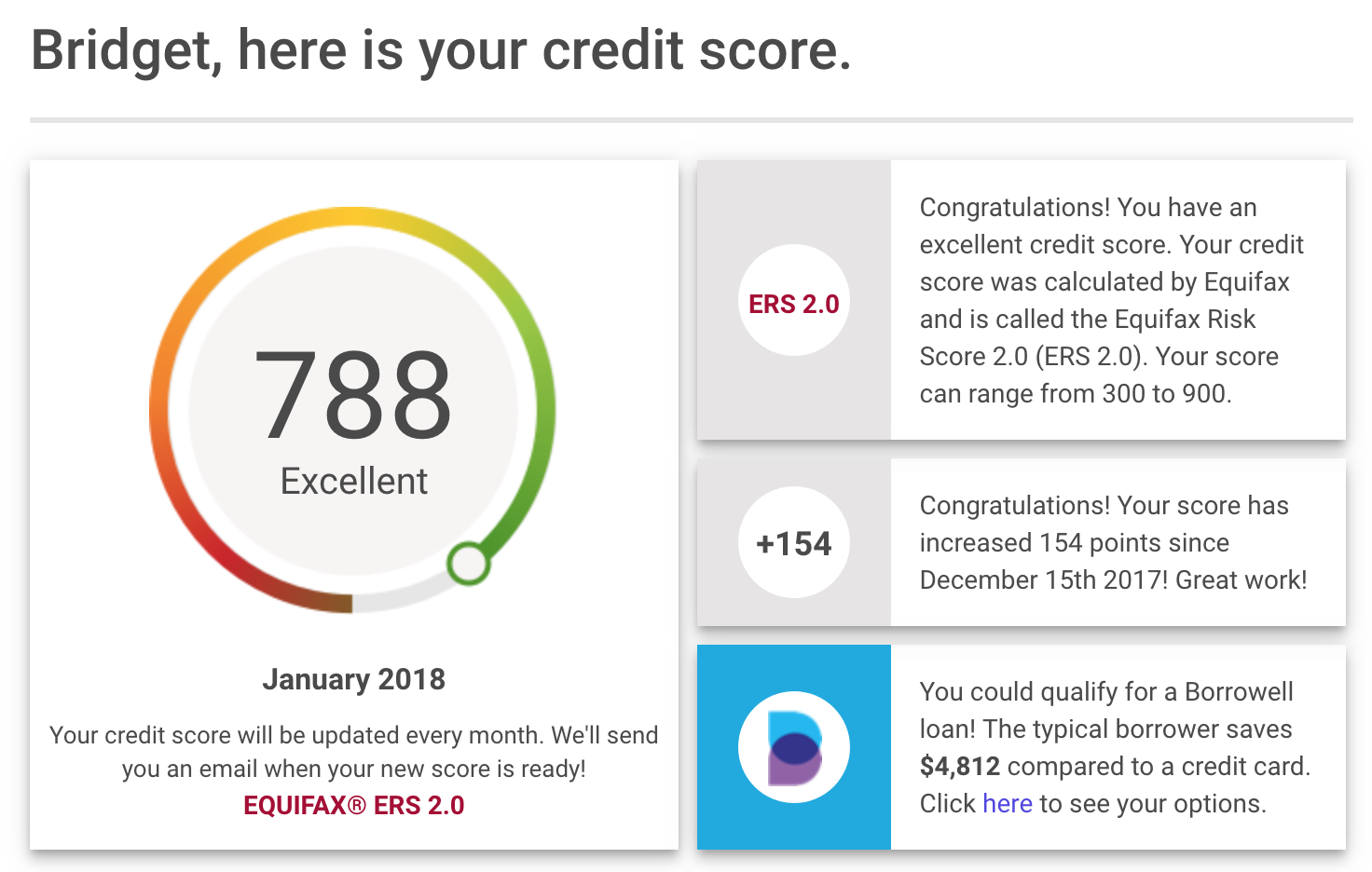

LOL @ the increase since Dec 15!

Borrowell emails us your up to date achieve month-to-monthand a directory of like I’m performing month-to-month.

In advance of this, we by no means inspected the score. My spouse and I didn’t caution exactly what it appeared to be! I did, however, get my favorite credit history when every year. This became large, reliable demeanor, additionally it ensured it may use w provided one year to catch an error. Since you see my grade on a monthly basis, I’m sure directly if a thing is certainly untrue — now i’ll see exactly what it is just as fast.

And Borrowell recently introduced an excellent pleasure business oriented concerning proven fact that you can examine your own record any place! Click in this case to watch the 30-second section.”

Buy credit history

As soon as I owned this $0.66 accident, there was exclusive been signed up Borrowell’s daily score improve. Whenever I wanted to ascertain how our success was basically tanking, I simply required this broad credit profile the laborous retro ways: by uploading a software with a photograph of my personal driver’s permission to a credit reporting firm, then ready and waiting 2-weeks for my medium are accountable to appear in the letters. This is both unproductive and seriously anxiety-inducing.

Any time my very own describe last but not least got, I experienced going line-by-line through sites until I stumbled upon the reason why matter happen to be awry. i’m hoping to need to do everthing over again to make sure that our compose ended up resolved, prior to my favorite thirty day hanging time frame seemed to be right up, Borrowell really founded furnishing liberate credit. I used this rather than!

If it weren’t for your chance of identity theft, I’d submit a screen grab of your entire credit file here because on Borrowell, it’s amazing. It actually wasn’t the 10-pages of little breed font I was employed to! Instead, was basically a tidy review of where exactly My spouse and I endured using history and the latest bill, and all I was able to broaden if I wished more information

Futhermore, in the bottom systems inform, in addition, it had an area to establish if a thing was a student in graver trouble, like in choices, or if i used to be recovering from bankrupties.

Of course, reviewing the credit profile in this manner was ever quicker the eyes, and achieving access things immediately was going to be 180p.c. better than the earlier snail-mail way I’ve used within the last ten years.

A way to increase fico

I’ve carried out alternative web sites and YouTube videos on this particular subject matter, as it’s continually a hot petition.

APPROPRIATE POSTINGS:

- 5 Simple Actions to make A Good Credit Reputation

- Tips Cheat Your Credit History

My spouse and I won’t re-state the information and strategies I’ve said before, but i wish to lend various new cheats into the mix:

- Course your own credit! Once you discover your credit rating, you are aware how significantly you’ll have to see ensure it is to “Excellent”.

- Break seeking even more credit! Each time you find your mastercard or loan, this matter as a “hard analysis” on your own credit profile and will lower success. These inquiries stay your credit report for 3 to 6 a long time!

- Wait and see! My spouse and I pronounce all of this attached, but following manufactured its the most crucial elements of increasing your score. If you should’ve manufactured banking blunders before or acceptn’t had the chance to hold a mortgage earlier, pay your current achieve a chance to gain. While you always pay your bills online and broaden the types of credit ratings you have got, the account is certainly going ahead!

Don’t forget to avert providers energizing one for accomplishment security or credit repair agency. Getting the credit rating plus credit report is free of charge, so you should never have to buy it. Likewise, account can not be “repaired” or “fixed” for a fee — the single thing that will deal with less than perfect credit is excellent credit habit and time!

Acheiving terrific credit history is usuallyn’t effortless, but in the case that you control your hard earned cash and personal debt easily, it will materialize all on its own.

This post appeared to be paid by Borrowell, however belief and experience portrayed with it were a.