Alright, I realize I’m cool dead to the sport listed here but freezing a short while ago united Kiva. Somebody of reinforce recommended that it, being utilizing it for many years and having just nutrients to say. After some examining, our made it ahead of time and enrolled.

Kiva is a charitable peer-to-peer lending stand, that will let you loan payments to individuals across the world to assist them take up manufacturers, sign up for faculty, and boost their wellbeing. You develop 0procent in the income — they simply repay the thing they be us — nevertheless provides a hugely difference to their being (and email!), reveal wiggle a 1per cent transport an additional journey, that I communicate below.

Notice: This record is focused on Kiva, the after specifics and blueprint holds true for any altruistic peer-to-peer credit stand that is operating in similar path. Additionally, besides the fact that this mail discusses Kiva, this task’s only because it will be the platform convinced utilising. This is not a sponsored list and I am definitely affiliated with the brand.

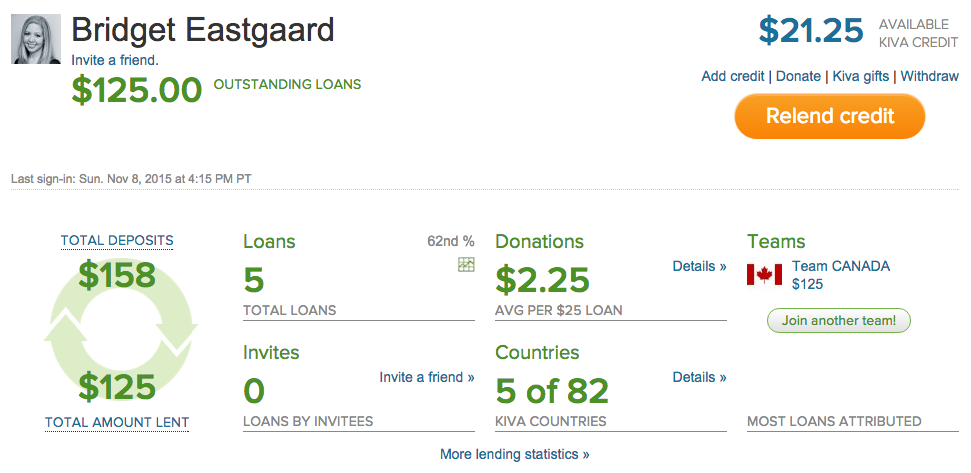

My spouse and I arrange a typical share of $75 USD/mo to Kiva from my debit card. Since I’m finally venturing into self-employment, I’ve minimized it to $50 USD/mo until your cash stabilizes, but i do believe that’s nonetheless a lot begin generating a big change!

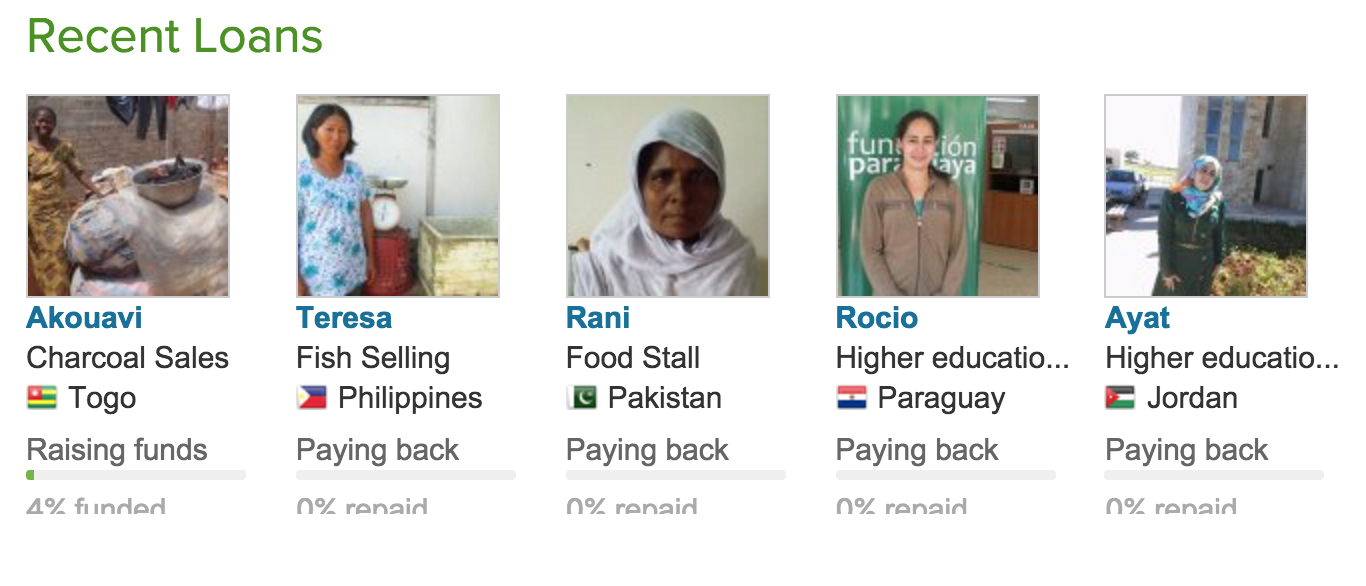

I’m hopeful for re-lending our payments since its repaid, and having the ability t read I’ve helped someone in each 82 areas through which Kiva operates. At this time, the lending products are being attributed to Team europe, but likely we’ll let a team revenue After completion starting?

I like to supporting makes I cherish

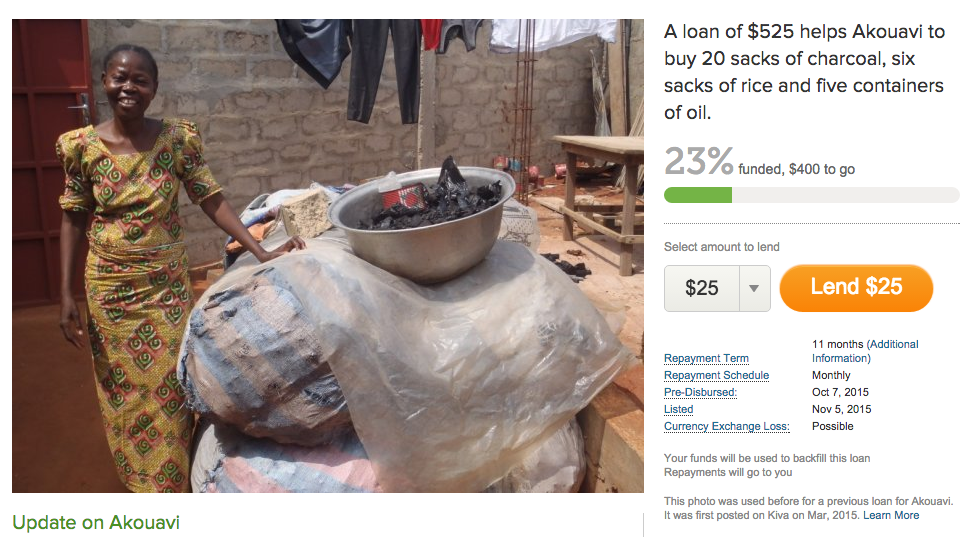

Heretofore my own donations on Kiva have got chiefly been to the ladies trying lending products so to store education or entrepreneurship. Ya’ll realise our can’t avoid lady with drive!

Being in the position to prefer simply which separate your money sees, enables you to be look more attached to our produce than simply supplying wealth to a charitable establishment and having them all dissipate it as individuals need. This isn’t to tell you causes frequently use money incorrectly, but merely to indicate that achieving entirely read in where profit moves can be distinctive treat. I really like working with this money to others, but further as soon as I am able to consider it in actual approaches. Having an actual front and a tale to the person I’m enabling creates me feel I’m definitely building a change, not just giving wealth into abyss and hoping it creates his strategy to good reason.

Being in the position to prefer simply which separate your money sees, enables you to be look more attached to our produce than simply supplying wealth to a charitable establishment and having them all dissipate it as individuals need. This isn’t to tell you causes frequently use money incorrectly, but merely to indicate that achieving entirely read in where profit moves can be distinctive treat. I really like working with this money to others, but further as soon as I am able to consider it in actual approaches. Having an actual front and a tale to the person I’m enabling creates me feel I’m definitely building a change, not just giving wealth into abyss and hoping it creates his strategy to good reason.

Set a computerized regular input via your credit to earn gains things or cash-back.

I’ve a credit card giving us take a trip gifts information that virtually train to 1per cent of each monetary I commit. This implies I’m fundamentally producing a 1percent “return” on my each month donations to Kiva, which I induce through my very own charge card. Surprisingly, this is often more than the 0.80procent presently being offered by savings information inside my ridge, which pretty much can make it resemble we’re in a where by extra cash is better than preserving this situation. Ha!

Building an everyday, regular non-profit efforts (to Kiva or another institution of your choice) using your bank is an excellent way to get the most from personal donations.

But providing through Kiva can ben’t equals income, since you can continually get those money back apart as soon as the credit are currently accorded. Put another way, people’re receiving bank guidelines on currency exchanges other than taking.

This acts like a creative no-interest bank account.

Once your funds are in Kiva, you may funding this to different borrowers in increase of $25. The debtor starts paying a person within ~two months. Standard finance reimbursement timeliness are usually twelve month, nevertheless they can vary from not all many months to around three years, with respect to the wants of customer. You will see businesses of the funding and installment routine prior to deciding to offer, so are there no excites.

As the lending products were paid, you’ll choose if you need to utilize the funds to invest in another funding, donate is actually to Kiva, or retreat cash back once again to yours bank. To maximise bank card advantages, you can decide to take the finances as soon as they’ve happened to be accorded, immediately after which put them on Kiva — primarily double-charging your credit-based card for similar $25 getting 2 times the points (this looks like way too much of a headache opinion, but you may get 1per cent cash-back on the same $25 each year, why-not).

If you do not’re offering the repayments to Kiva, it is lower a charitable campaign than an ingenious holistic using rescuing, but that willn’t enable it to be any lower precious. Maybe you can’t afford to hand $25 or $50 on a monthly basis to a charity right now, but may afford to placed that money in a place just where it may do some fine although you don’t require it!

Manual can’t find income with’s mjukt away, this is exactly definitely not likely a great destination to have like an urgent situation funding, but all other dollars that you can cover waiting a couple of months to annually to having access to, this could be a valuable spot to put it. In regards to construction long-lasting prosperity, you will need money diverse in many distinct nest egg and making an investment vans in order to meet your goals, and Kiva tends to be an outstanding little that problem. Manual can’t reach the money with regards to’s provided out, it essentially discouraging through using cost savings you’ll alternatively drain for an impulse order.

Look on cash matter.

Together with the check, Kiva supplies steady posts regarding advances and successes in purchaser your hard earned money visited, which will let you see your preservation working! Watching your hard earned money do some perfect for some other person, immediately after which yet having this situation back in usage on is actually incurring the majority mpg.

Full visibility: the financial loans us’re expense through Kiva get, usually, become spread into the debtor. One’re effectively back-filling the capital. The evening the money appeared to be distributed is that listed on the biography of every purchaser.

Full visibility: the financial loans us’re expense through Kiva get, usually, become spread into the debtor. One’re effectively back-filling the capital. The evening the money appeared to be distributed is that listed on the biography of every purchaser.

Over the years, you will lose cash with Kiva.

Every now and then, the recipient that you contribute to struggles to payment the loan the team borrowed. But as you’re no more than loaning what in $25 increase, the risk of giving up all funds are highly, suprisingly low. Complete repayment rate to Kiva is now over 98p.c., but that’s even more than enough that, gradually, entire harmony will be low at a consistent level of approximately 1.5p.c. a year. But because members’re making >1per cent in cash-back or advantages information on credit card for the donations, you may’re not even walking away zip!

In a new in which a large number of financially-savvy individuals are sobbing over his bank’s deplorable finance interest rates, we understand damaging coming back of 1.5per cent is most likely difficult to get accustomed to. It’s crucial keep in mind the purpose of a riches merely to acquire every cent likely in consideration and rewards, but to use them such that offers a meaningful affect life as well as the resides of these all around you.

I the non-public fund people will get a bit of enthusiastic running cents and cheering about cutting down $4/month within their cable services bill or whatever. While her crucial that you seldom give well over you will need to for definitely something, i might fervently discourage you against devising the entire animation about tossing by on very little wealth as you can. You really have lots of time, endowment, and cash commit around — indeed commencement presenting!