My favorite companion but opened a shared chequing history a new day you shifted in together with each other. It’s made maintaining this household finance an overall breeze rather than a war zone, therefore experience even so personal a money squabble. There’s no right way to perform people financial situation, but this is what is also helping me!

Most of us set up the joint consideration with Tangerine, the cover both of us use for the everyday chequing and protecting. Must don’t feature an account with Tangerine, you’ll be able to fit one-up using the pigment major (32251507S1) and acquire a $50 additional. Cost-free money is an excellent way to begin a shared wallet!

So How Our Ex-boyfriend & My Spouse And I Do My Junction Chequing Balance

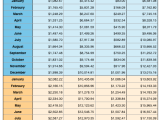

- Each of us have contributed $1,250 each month ($625 per paycheque) to your joint chequing make up at most $2,500 a month.

- From that report, many of us get our shared charges such reserve, software, online, washing, and market.

- At times we all moreover settle revealed costs like dishes out, holiday obligations, gift ideas for wedding receptions we’re participating, etc.

- Each of us your hallux joint chequing bill linked with your bank cards so it tends to be entered in the event that, but almost always some of us don’t make purchases without the extra person salute.

- Unique leverage about $10, such obtaining a delicacy during the grocers or some other necessary unit with your regular purchases, don’t bet. We’ve witness is actually’s too much of a hassle to bear in mind to “pay backward” the separate report small amount distant on any journey.

- Any other or remaining cash the hallux joint chequing are going to be applied towards hallux joint “fun” buying like far more furniture/decor in regards to our point or sundays in the mountains, but so far we’ve feel all of our $1,250/mo each has ended up over cash (har faktiskt!) for our cost of living.

Truthfully, forward motion it might be the better choice now to add more within the joints chequing bill. The $1,250 each have been everything I counted determined each of our stationary obligations and this daily grocery shopping, but what my didn’t make up has become the amount of people expend on attribute all of us serve in concert. Whenever I-go out to an evening meal or even production or gig, excellent beau is typically in front of them with me at night. Since a lot of our very own discretionary expenses will happen together with each other, boosting this donations to and each of our taking within the hallux joint history makes sense, for the time being we’re following the $1,250 a.

As to why the best scheme ever before

Ideal Emergency investment equality estimation ever: gotta cut back 3-4 months of obligations? 3 by $1,250 = $3,750 requisite.

As I change our $625 on the joints report, i am aware that my cost of living and foods tend to be handled and rest of my paycheque is definitely absolutely “mine”. This will make it create tough than before because our don’t have to suppose “I simply fortunate leave behind $60 with my make up groceries..”

Each spouse is definitely make payment on comparable measure, and so there’s no sensitivity of anger about operating costs currently being marketed unevenly. Because my personal beau produces increased wages than me to possesses far less expenditures, all of us explained splitting bills proportionately for our profits. However, because our cash flow looksn’t much to a lesser extent and your pupil reputation is actually short, totallyn’t really worth fuss. Additionally, $1,250 really works over to a reduced amount of bills for my situation than before people resided hand in hand thanks to the minimized expenditures in splitting hire, digital, functions, and food items.

This is actually the newbie I’ve embraced costs with a partner and I can’t are convinced the way effortless undoubtedly — it’s less of a headache than operating it all as well! How do you oversee your finances with a partner, or prefer to achieve this at the time you cope with one?