After toil date is back to college for almost all Manitoban college students. I understand a number of individuals start the college yr mid-to-late june that’s very freaky and produces this delegate slowed, for we excuse but I simply can’t adjust a awesome Manitoba options claim there won’t be any dojo before October.

Best Ways To Schooling?

“recognize not about virtually and I be $40,000 sell” – Laci Renewable

And so the theme of these video may be much more play compared to the subject of money, but we should discuss this task. Have a look at far more “fun” ideas, monitor even more Laci blue video lessons, she’s rad!

The beginning of the institution same year is always a good schedule: you happen to be completely not aware of exactly how problematic the classes shall be, you haven’t not detected just about anything very important so far, and maybe additionally, all college scholarships, education loans and savings are usually placed unspent in the history. You may be a a little/lot tempted to pass — naturally, precisely what good is definitely dollars if it’s not used to decide to buy joy and happiness?

Advantageously, first of all you must is absolutely not waste all of your funds.

What i’m saying is the application. Simply just provide it with a short while to take a seat in your balance when you mull that over. Anyway, you want to have got a chequing profit with ING, which in inclusion to no cost furthermore offers that you stake, this means keepin constantly your cash in your bank account definitely gets you money (and if a person sign raised in my fruit Key 32251507S1 anyone’ll become a $25 advantage. Don’t suppose I do not had nearly anything for every person!). Once you’ve utilized the vague artwork of in no way spending-money, the application’s time strategically decide how to pay finances. 1st object can be, of course, dojo. Then deduct the buying price of all of your tutelage and references from whatever is in your bank account and experience precisely what’s position: that’s your hard earned cash. That’s what you’ll get to invest. And here is how In my opinion you really need to invest things.

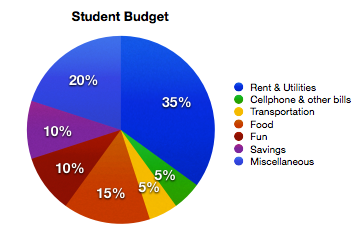

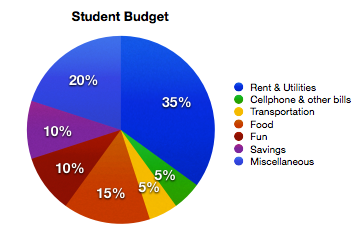

It has to only price about 35procent of cash flow (or student education loans or scholarship funds or however you’re sustaining your body in school) to keep a cover over the head. You can waste another 500 on monthly dues just like your cellphone and Netflix. I set up travelling at 5% because I’m seriously intense believer that learners ought to be dedicated to using community journey, particularly since it’s frequently no cost in your school fees at Manitoban institutions, but I’ll go back to zygor. Meals are at 15% only because I’m visualizing you’re absolute on an excellent minuscule learner funding the place quarter-hour definitely measures to a pitiful handful of hundred pounds. Must’re rollin’ in hard cash there’s absolutely no reason to flaunt on caviar to really get your food items shelling out to 15%, but My spouse and I digress. ten percent on pleasure since you but both discover you ought to be exploring, just in case you must party harder than ten percent, take it out of your sizable food items discount. 10% on financial savings, because there’s graduating out of cash and there’s graduating the precipice of poverty, and I also would like you in order to complete your own academic degree with profit the. As a final point, twenty percent on Mixed. Precisely what is miscellaneous and just why used we devote a great deal revenue truth be told there?

Given that it’s crucial that you experience barrier area in your funds.

Probably portland you live in can be super overpriced and there’s absolutely no way there is reserve for 35per cent of source of income unless that’s a train housing, which means you need more cash there. Perhaps you live in an urban area that mayn’t trust in earth sustainability features no trains, buses and taxi’s to dicuss of you’re obligated to manage a vehicle, creating personal transfer reimbursement greater than 5%. Or your capacity to pay adjusts every month: unforeseen bill show up, you’re going overboard on food items, anyone lose a shift at the part-time workplace and consequently your income is a little little. Achieving some more in the month-to-month fund may keep you against sinking to your sudden money (I am certain you’ve a serious event funding, because’re vigilantly economizing 10% as stated above).

Budgets aren’t hard, people’re in reality rather bendy and you’ll pattern those to satisfy your life. Really the only difficult law is basically that you can’t save money than you may have, but other than that this’s actually your responsibility where you must put your profit.

Individuals going back to school, look on the cash take pleasure in these number of years — except much that you’re obtaining them all for decades once!