Quite possibly the most important item I’ve perfected inside my MBA much will this be:

“Always get the laziest owner perform the challenging job, because will find the simplest way to acheive it.”

Talismans to your internet marketing teacher for all password of content, because conscious he’s correctly. I mightn’t illustrate personally as couch potato, but once i could discover a non-destructive icon, I’m all over the application with additional enthusiasm than a 4yro at an electricity Rangers birthday celebration (the Power Rangers came ultimately back, correctly? Conducted that materialise?). This is oftenn’t a terrible thing. In fact, i’d believe they’s effective. There is certainly valid reason to read through, find out, connect, await, pay, or study beyond you’ll have to.

Overall, information and facts and activity become repeated and worthless, after which then they develop into a total waste of your time.

We don’t have enough time to trash. Nada men and women create. In my opinion the majority of our very own a long time should really be devoted nourishing our new faces, the connections, and our very own communities — but however this is extra a lot of us can’t spend. Nonetheless, there may be a “lazy” way to get truth be told there.

5 Cutting Corners To Lifelong Abundance

1. Happen car-less. The mediocre price of automobile relation ends $5,000 each year — that’s $417 a month. It’s advantageous to nearer to your working environment and give relatively special in book in case implies axing your automobile account. Strolling or bicycling efforts are perfect for your overall health, mid-air, along with your purse. We’ven’t operated your car in about years, and I’ve run by 1) surviving in a central position with full having access to public transportation, 2) benefiting from car-sharing plans like car2go and 3) leasing your vehicle for longer trips when needed. In 2013, We contributed simply $850 on transport. Regardless of whether family car ownership is certainly inevitable inside generation, the much longer you’ll procrastinate, desirable.

2. Cut your salary. The bulk of results will depend on a few self-disciplined offices day in day out, 12 months in annum out, but every now and then, there’s suppliers might create an enormous variance with very minimal exertion. Those types of attribute looks talking your wages. This is certainly an approach to become thousands just by by wanting to know. Essentially the most polar time period has to be your establishing wage photos very first task away from student because this designs the base throughout your operation profession, nonetheless it’s good to get if your occasion looks given to you may during a performance evaluation, offer, or career transfer. Usually invite more cash. Survival in an uncertain future quite possible deal that appear is also you’ll be explained to no.

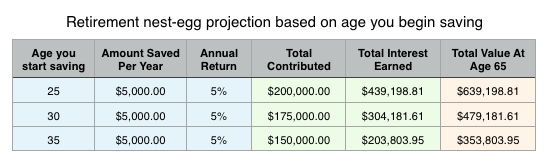

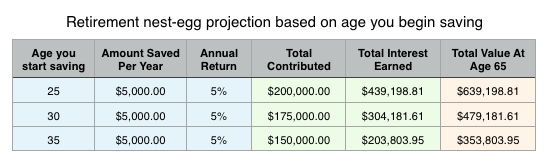

3. Begin preserving for retirement plan in the 20’s. I understand, one’ve observed the application and you also’re bored stiff, any time all of those other big set is usually stressed to squirrel outside ten percent of these profit throughout their being employed oprah winfrey network, the trendy boys and girls that just originated from her 20’s might be a great deal prior to the plot. The business is scary. Here, i did so this for every person:

Perhaps you have realized, someone that takes place cutting down $5,000 each year at age 25, might be with nearly $200,000 much more by time 65 than somebody that initiated saving money at the age of 30. They will likely experience over $300,000 greater than someone that started off protecting at age 35. Additionally, the saver that initiated at 25 earn thousands pounds a lot more in interest — that’s no cost wealth. Meaning of this journey: commencement saving money in your 20’s.

4. Optimize your levy results. Our search this was good to since ’tis the summer season, but by far the most convenient how to you should’re protecting everyday often support everyday in take-home be. In your 20’s, this can be chiefly about saying things like student loan desire, shifting expenses, open pass and medical-related fees, or any newer home gains. As you get experienced, it is going to be a little more about depositing finances into the ideal expense motors within the proper reports (TFSA vs. RRSP). You ought to be comfortable doing your very own taxes, but if you become self-employed or should run a business enterprise, it could be rewarding getting help from an accountant. Simple fact associated with the thing is the more funds you get and place, greater sophisticated running gonna turn out to be. It’s advantageous to understand your skill to attenuate anyone yield in fees.

5. Reside an alternate life. You desire a genuine shorcut symbol to plethora? Intercept analyzing magazines and catalogs. Don’t determine realness video. Load choice you think of the best thing and what you want, and the way you observe everybody. It’s more straightforward to skip labels any time you understand how us’re getting changed by promoting. It’s better to ban low priced, throw away clothes if you decide you’d moderately end up being awkward in cheap fabric. You can actually prefer to perform a little bit of family maintaining with kitchen items like acetic acid and baking soda. You can actually decide upgrade your device or machine at any time 2,3, or perhaps 5 a long time. Long lasting accrual of money are all the as to what devote mainly because it will likely be precisely what you get. Some picks will issue well over some, but actually a compact alter will add as much as a volume over forever. If you need to proceed actually intensive and stay off of the power or on a hippie commune, so hey there, Im behind you, however, if you would like to begin a community flowerbed, I’m behind that equally.

Become relaxing, consider the easy way.

Having an icon to plethora, please percentage inside opinions!