Here’s your facts pleasing scale account spending, an easy method of capitalizing on homecoming and reducing threat before committing to stocks. A few days as I composed a post vocal singing the praises systems Canadian idler case, these revealed its 2015 re-balancing allotment.

FYI: In order to create an ETF determine finance accounts, as gone over article, you will need a broker consideration. I prefer Questrade, because it’s liberated to get ETFs. Staying exchanging prices humble has become a fundamental piece of assisting me to produce success wasting. In the event you’re equipped to get in industry and initiate buying, My strongly suggest opening and reading a TFSA, RRSP, or unlisted accounts with Questrade to get going!

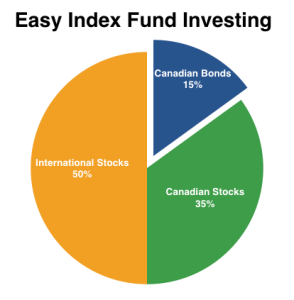

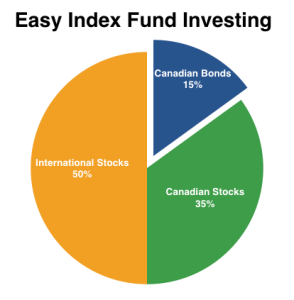

Comfy Listing Finance Investing

The Canadian Couch Potato catalog investing technique at present exclusively is made of three funds: VXC.TO, VCN.TO, and VAB.TO

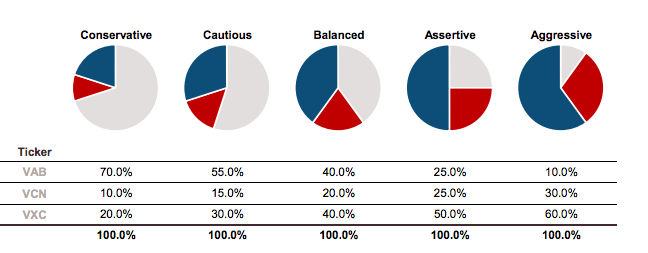

You are allotment over these three capital will depend on your possibility threshold. You could take a peek from the completely different breakdowns of advised proportion here.

The existing allocations placed more ETFs — XRB.TO, ZRE.TO, VXUS.TO, WTI.TO, as well as the varieties that mentioned above that define this new inactive Strategy — depending on personal peril lack of resistance and function measurement. Lessening the inactive to merely three budget may seem like a big change, nonetheless’s really just reduced the portfolio’s risks while having basically alike subjection to marketplace.

Many of us will question, “can You will find a thoroughly stabilized buy collection with only 3 resources?”

The answer is YES.

The resources advisable by way of the CCP collapse below:

- VXC.TO – worldwide collateral (anything except quebec)

- VCN.TO – Manitoban Resources

- VAB.TO – Manitoba Ties

From which view you will maintain both stocks and alliance in your selection, and then have both community and worldwide coverage. You can actually revise exactly how much you hold in each based upon exactly what real estate investor you happen to be. For example, if you happen to be an cautious, risk-averse capitalist, may choose to spend way more in VAB, the Manitoban attachment finance. Anybody an aggressive, risk-tolerant person, you will devote a lot more in VCN and peculiarly VXC.

In order to really limit taxation, you’ll want to restrain VXC through your TFSA, and only hold VAB and VCN. You could control some of the financial resources within your RRSP.

On top of axing lots of the endorsed ETFs, the couch potato scheme different in simply how much that it propose that you have in funds for every single investment.

In the event your portfolio size is….

$0 to $50,000 – The Tangerine Expenditure financial resources (which I in addition cited my personal recent mail about förteckning dollars) do your best option. These are definitely well balanced listing profiles with very low expenses. I’ve been shopping for Tangerine income provided I’ve happened to be deposit with Tangerine (over 5 years) as well as’ve really been fabulous for harmony and revert.

over $25,000 – The TD e-Series money. The CCP basically suggests four different e-series money for balanced selection. It is possible to view these people below. We’ve myself never ever utilized the TD e-Series cash average joe, but I am certain other blog owners practice e.g., salvage Expend ostentation and Krystal of Give Me Back a few us dollars) and they have simply nutrients regarding these. It sounds like these’re slightly problematic to install, but when you finally begin they’re quite easy to control.

over $50,000 – The ETFs listed in this upright. At first ETFs were definitely mentioned mainly for people with significant portfolios, then within the last four years they truly became sophisticated for every individual, now it looks like we’re striking on a lot of money also. My set out committing without $50K and nothing blew off inside my look, but i real careful attention let me reveal because ETFs is often expensive for sell. However, I prefer Questrade which will let you investment ETFs for pretty much complimentary (usually costs you me personally $0.01 to $0.03 in making a trade). As a result, things’s quite reasonable to duplicate the CCP strategy without a lot of than $50K.

Individuals individuals, the CCP is the best angebot — although it looks simple with merely 3 finances, it really is best. Others like personally may wish extra “fun” available in the market, and use the CCP as a foundation now prefer to acquire more specific ETFs or mutual lineage. As an MBA in credit we can’t facilitate but should have fun with the sell quite, and so I set aside many my personal leistungsspektrum to the investment decision methods, but the middle that continues to be the CCP concept