Retirement may not be a top-of-mind concern for a 20- or 30-something, nevertheless these are your nice years saving for future a person. Thankfully, this situation’s incredibly straightforward add million coin TFSA!

Exactly what is the Tax-Free Savings Account (TFSA)?

The Tax-Free checking account was produced last year to greatly help Canadians cut costs. This history looks particular because any purchase cash flow acquired inside it is completely tax-free. What this means is any awareness, rewards, money progress acquired around the history won’t be exhausted. You’ll leave $500 if in case several years eventually this task grows up to $1,000, you are likely to yield NOTHING TAXATION on that.

The absolute right place to put your TFSA will be Wealthsimple. We’ll read more and more that further, however if us’re pressed for time, enlist now even to get your beginning $10,000 controlled free-of-charge.

The tax-free electric of the TFSA will make it very preferable over any tax-shelter, for example the RRSP. If you decide to’re trying to select amongst the RRSP in addition to the TFSA, the TFSA is almost continuously the better favorite with very few exemptions. In case you are really uncertain, pick the TFSA initial. With, you should take funds from all of your TFSA in your RRSP without outcome, people can’t go additional means!

Want to have more detailed reasons? View these postings!:

- Model 2019 TFSA Explained

- Everything You Need to be informed about the 2019 RRSP

- Wealthsimple Critique: Uncomplicated Dealing on Autopilot

- The TFSA versus The RRSP

Every person need a TFSA. After they serve, all you need to act looks record your gross annual and oprah winfrey network sum boundaries, after which exit majority to the bill total it is imperious work on.

Does a TFSA become million cash possession?

Any time you’re portion 20’s or 30’s, the only method ones TFSA won’t be a million-dollar resource is actually if you may don’t use it.

Yes, it truly is that simple.

Should’re greater than two-and-a-half decades beyond your retirement therefore night and day create all of your TFSA, you’ll end up an uniform. People don’t need to maximum it out (if you will want to try!). Set, self-discipline, as well as the share will be the miracle collaboration that develops a common tax-shelter the retirement you dream about.

Owing to involvement, off, and cash profits, a properly invested TFSA can become so many coin resource. All it requires is set.

How come make an effort for so many bucks TFSA?

The capability for its TFSA comes from its tax-exempt reputation. So long as you write $1 million funds plus in your TFSA for retreat, that will go wholly tax-free cash flow for yourself as soon as you withdraw. Secondly, because it’s tax-free financial gain in pension, it won’t produce any clawbacks on governance pension and subsidies you get, such as the CPP or OAS. Additionally won’t boost income taxes on taxed distributions off their benefits you’ve probably, like RRSPs.

Should Tax-Free family savings might be single vicinity you can afford to save, it would be just enough for retirement. We won’t necessitate anything else.

Presuming the memorable 4per cent removal fee, so many monetary TFSA provides you with an entirely tax-free income of $40,000 each year in retiring. Because this is TAX-FREE PROFIT (consume we mentioned things a sufficient amount of however?) the CRA will in actuality imagine you’re enduring on $0. You may’ll qualify for every low-income retirees edge on the globe. This is going to make the abundant reduced grandparent around!

This is exactly a dull conversing with a lot of theoretical figures for any person multiple a long time removed from your retirement, but my offer you will at some point really care truly about that suggestions. You will need to envision 76-year-old members transpiring fascinating trips really TFSA prosperity as the federal of Ontario always provides satiated Old-Age privacy like a low-income occupant. Stall, you ask, isn’t evading levy a fun someone issue? How come yes, nevertheless you’re a millionaire immediately so why not you personally, my friend, why not us?

Example: A 25-year-old keep many money TFSA by retreat

Let’s allege you are actually at the moment twenty-five years older. You’re born in 1994 and as a consequence feature $48,500 of time TFSA info home. We’ve ended up cutting down much in a TFSA with trust due to the fact spun 18, although extremely really, and that means you just have $10,000. You’re going ahead and unfold a TFSA with Wealthsimple because of the $10,000 people’ve now protected. Afterward you organize an auto content generated sum of $250 every twice-monthly pay check. You wish you can actually bring a little bit additional to catch upon empty share living space, nonetheless only don’t own suppleness inside funding at the moment. Though, even for your astonish, the TFSA even crosses the seven-figure brink by your retirement age of 65, regular at a modest refund of 6%.

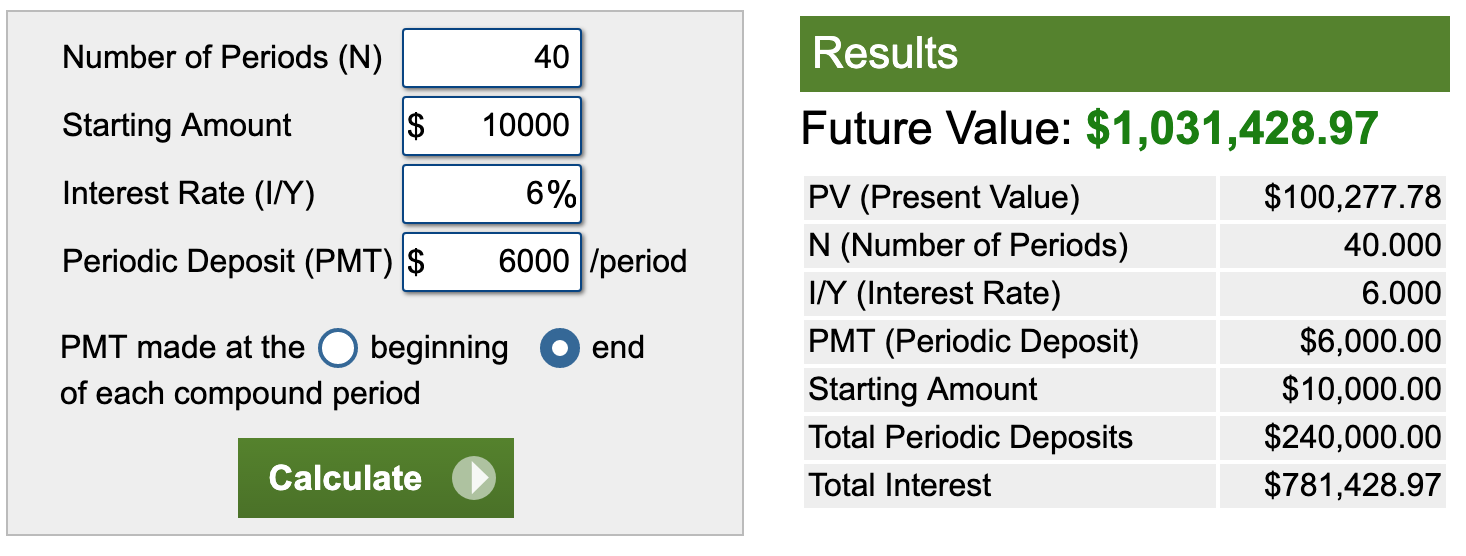

Future equity a Tax-Free checking account (TFSA) after forty years. Presumes a starting valuation of $10,000 and yearly efforts of $6,000 ($500 per month). The assumed fee of return within markets looks 6p.c..

Isn’t that wonderful? We check these merchandise for fun frequently and I’m continue to in wonder at electrical power of compounding.

If you can to max out old remaining info home, and/or the once-a-year TFSA bestowal restriction rises in many years forward motion, and/or you get a return higher than 6procent, you may’ll consume extra. Moreover, in case you aren’t placement improve your funds nowadays, or else you do not have anything put in a TFSA even so, is actually’s nevertheless possible for you to definitely put together a million dollar TFSA. You simply need to find the appropriate formula. If you need to play around with amounts and conditions, test this basic future worth reckoner at this point.

A Step by pace strategy to construct a Million dollars TFSA

Permit me to assure members that offering several bill TFSA accounts is obviously simple. Here you can find the procedures:

1. Open up a TFSA to get the stock exchange

Sadly, at up-to-date rates of interest, us can’t keep your solution to a billion money TFSA. Us’re travelling to require invest your hard earned money within the share if you wish to receive the fall required to develop a billion bill asset.

If you decide to don’t feel comfortable committing cash inside stock on your own, or you only want to experience a hands-off way, use the robo-advisor Wealthsimple. By opening up a TFSA with as few as $100, finances would be work during the industry. One don’t get to rise a finger.

On the flip side, if you carry out feel at ease researching stocks and causing your very own swaps, Questrade is the foremost budget online broker suitable organize your own function. You may’ll necessitate at any rate $1,000 to look at a TFSA, and now you’ll cause managing every assets.

2. Discover your health bestowal cap

In the event you’ve simply just launched the first TFSA, or perhaps you curently have a TFSA basically’ve happened to be leading to lackadaisically, the first stuff you’ll have determine is also exactly how much publication room you have got.

The Tax-Free checking account sum restriction for 2019 can be $6,000. However, us’re eligible to all giving bathroom that’s amassed since 2009 otherwise worked 18 (whichever arrived very first!). Within the sample above we both implemented a 25-year-old who was certainly not 18 in 2009. Yet if you’re change 18 or familiar in 2009, one’re truly entitled to the whole lifespan giving room. The lifetime giving for the TFSA has become $63,500.

3. Install an automated per week or monthly bestowal inside TFSA

Once your TFSA is established, the application’s imperative that you benefit that it daily. Added, there’s absolutely no way sell to develop to millions if there’s no cash in there. I would recommend prepare a frequent transportation from your chequing accounting inside TFSA that coincides with paycheck. By there’s always funds possible. Members’re “paying personally primary” before using your own paycheque for anything else.

Inside’re concerned typical transactions ‘ll get expenses together with your chequing story, it is advisable to turn a no-fee replacement like Tangerine or KOHO. After you have a merchant account these kinds of, put your own TFSA as a bill digest. Establish your normal month to month bestowal. You can also include other if you have got greenbacks to spare!

Personal reductions develops into several coin TFSA please’re careful. Although you may don’t write the seven-figure patience, tipping shortsighted continues to be adequate to have enough sleep during the night time. No body scoffs at $800,000 The bottom line is, emphasize our TFSA, given that it’s all you have to!