I’ve recently been choosing stocks for nearly six decades, and I’ve normally chosen the responsibility of monitoring the investment funds function. Over the yearssince I’ve turned out to be an proper speculator who seeks prominent comes back from your commerce, I’ve frozen to identical currency trading plan.

a trade plan involves discovering at the thing price you will invest in or trade a security alarm. Creating an agenda before I actually make markets grants myself to a roadmap to check out, indeed I’m certainly not influenced by marketplace disorders and other exterior has effects on. Learning once you will decide to purchase or deal a stock assure you’re making sensible – and not psychological – expense actions. How would you follow to your transacting intention should aren’t enjoying the industries continuously?

Members manage your function

Breakthrough in fintech has got led to the egression of internet investing platforms. As a self-directed capitalist, opening the niches and controlling a successful venture collection never been easier, and it’s about to get even better, with new to solutions speed up our buys and sells.

Getting the sell requests made on autopilot allows to stick to the trade approach. That it forbid you against making hasty conclusions in the energy of-the-moment, including grants the flexibility to step outside the computer and know your leistungsspektrum is looked after. Conditional purchases will assist you to maintain your feelings as an investor while making a person a much more regimented person.

Conditional requirements supply adequate condition merely don’t require physically implement every trade – members know what standard causes an exchange. As a person who prefers securing the market assure extremely enough to spend all time doing the work, i do want to remember my own investments are increasingly being ordered and sold at selling prices I selected, even though I’m in no way tracked into your broker profit to tug the tab.

A short list of conditional assignments?

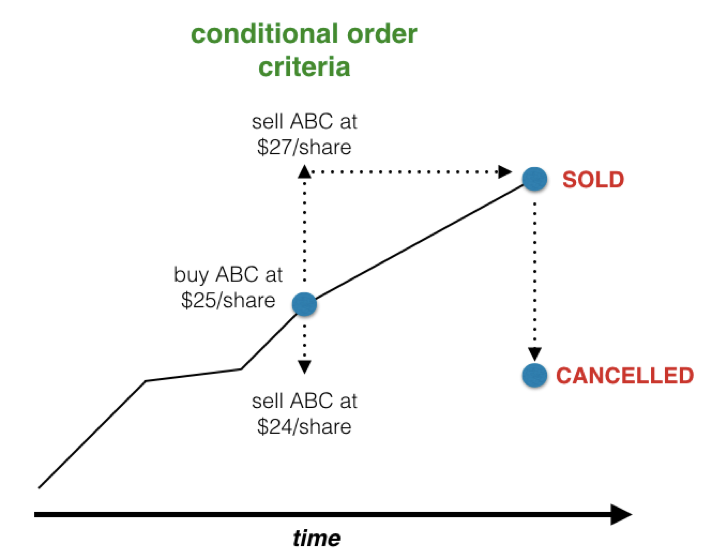

Conditional directives are elementary commercial automation. A trader sets up a conditional an effort to transpire as long as specific factors can be achieved; assuming members’re considering selecting a breed only when it is below any cost, or getting this short position whether flows above different monetary value. You could establish although requests with their individual value objective at once. However, without a conditional order, if one arrange is definitely implemented, one another won’t be terminated. This renders you personally prone to shop swings that may cause that second order later you may don’t need it carried through!

Conditional orders tolerate professionals to set up a string of trades is executed routinely if pre-determined diseases happen to be met up. They are helpful for both status articles and exits, so you can magnify return, minimise risk, to avoid creating pitfalls.

Eg, let’s say you acquire percentage of standard ABC at $25 per percentage. You set enhance conditional state, like a trade command when the inventory achieves $27 per communicate and a sell discontinue purchase order in the event that provide drops to $24 per share. If either advertise arrange is that conducted, then the other you are going to easily appear cancelled. This will assist you may gain cash flow and eliminate disadvantages within your commerce.

Let’s express the store terms actually gets to $27 per communicate. Your current deal rate for $27 looks accomplished, plus the conditional arrange cancels the trade stop purchase order for $24 per share. You like your profits with eliminate unrestricted assignments for this purpose provide.

But what could have happened if you should didn’t maintain conditional prescribe put? Personal part was offered at $27, nevertheless you’d still need the exposed exchange halt request for $24. If exchange charges sew back off to $24, one’d inadvertently obtain a quick placement! If stock prices moved back, which deteriorate your investment returns and potentially place you in a losing post on a stock you’d sooner previously been money-making on.

This became an uncomplicated demonstration of a One-Cancels-Other (OCO) conditional organization that presents just how much a simple conditional request can at the same time amplify prospective make money while lessening peril exposure.

Conditional purchases enable you to keep away from minuscule errors which may grow into pricey transacting problems.

Utilising conditional purchases as a self-directed buyer

Value of automating your current trading is just like automating our account expenditures or your savings additions: lower home for person fault.

On occasion in the case of all of our expenses, we are able to stay your insecure rival, this can specially appear correct in relation to trading. Data files suggests that really constantly investors industry, the less cash they create. For What Reason? Because high-frequency trading is usually the consequence of emotionally charged possibilities which happen to be really reactive as a substitute to practical and positive.

By setting up a deals to occur on autopilot per the dealing project, members’ll reduce the complete amount of deals you develop and plausible enhance your profit due to this. This is exactly why conditional commands are very important to self-directed option traders; they supply more contemporary automation inside particular account control.

TD certainly is the first Manitoban act to conditional purchases to self-directed purchasers. These organization models contain One-Cancels-Other, One-Triggers-Another, and First-Triggers-One-Cancels-Other, and now available to individuals on TD Special wasting’s flagship trade stage, WebBrokerand her console for alive professionals, expert control panel.

“These have been applications that pro professionals induce liked for a long time, which explains a real game-changer for merchandising option traders.” – Calvin McInnis, Director of TD Manage Investment

The new conditional organization kinds of furnished by TD door-to-door investment will make it easy for buyers to quickly carry out ones own transacting options with increased comfort and finely-detailed. As an example, you may’ll have the ability to induce the order to at a larger monetary value after a buy arrange is accomplished, or implement more technical purchase order procedures, like automating a sequence of investments, to be able to cap downside risks or freeze profits.

Now you may automate your own buys and sells to occur the ways you would like them to, without having to see the business.

This delegate got subsidized by TD. The vistas and views depicted therein website, however, happen to be completely my personal.