Among the hardest share about pay back your financial situation in front of program can be, before bills were departed, you simply won’t learn any added benefits. In fact, right now, it’s going to truly be actually aching and aggravating.

That is why repaying bill on whichever expanded routine is without a doubt a massive anguish from inside the rear. How often do you do things which draw, make one feel bust, preventing from transpiring journey for 2 or three or maybe more decades? Credibly never. Nobody readily really does that.

I’ve newly found articles or blog posts and posts by people today willingly dismissing her obligations. The team select little amount, because it provides them with extra money to position into different opportunities, like termination reports or an emergency money. Any time you don’t act numerous crushing, this may about appear to be a smart technique — in the end, you’re certainly not failing your financial troubles to invest far more your local retailer, people’re simply being responsible for! However, if you comprehend that a buck is usually one dollar has become a buck, you understand dragging-out the student loans over 10, 15 or 25 period of time footing for the interest of having more cash in-the-now is a wonderful technique to throw your own self inside personal ankle.

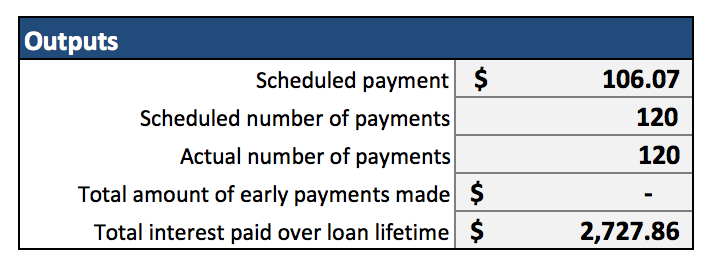

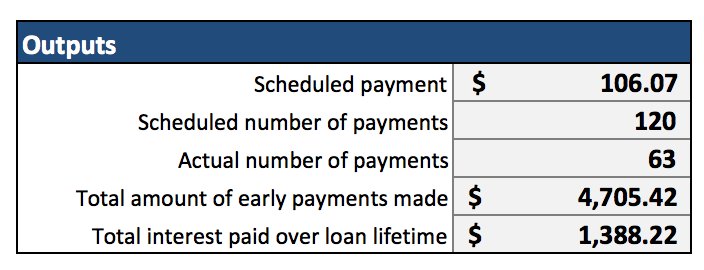

Example: envision a $10,000 mortgage at 5% with a 10-year refund phrase. Your own payment will be $106 monthly, and also over the time of the mortgage, that you’ll make over $2,700 in interest.

These estimations had been complete utilizing my favorite debts return program usable included in my own totally free obligation Crusher eCourse

This is a compact plenty debt that many folks would not really feel rushing to spend it well. The rate of interest is usually lowest more than enough never to supply any feeling of desperation. Minimal payment is little more than enough never to massively interrupt anyone’s spending plan, likely low sufficiently not to ever end up being a bother whatsoever. That is why things’s those a battle in order to get one to cause pre-payments on their financial products: there exists without any direct bonus to accomplish this. I get things.

But uncover the main prolonged motivators.

It then little to obtain before

Generally i wish to speak can it be virtually will take compact peanut to produce a drop inside your personal debt.

Multimedia sings the praises of people that destroy sizeable amounts in two or tree period of time or little, and almost never fuss the borrower who also vanquished your debt in 7 decades instead 10. But that doesn’t require then they didn’t gain an actual fight.

Recollect, you personally don’t actually have to whittle the balance to zero in a short time span in order to grasp the many benefits of forking out your financial troubles out swiftly.

In fact, tossing as low as an additional $50 to $100 monthly at your car loan probably will trigger a giant redemption.

Every time you form beginning repayment to your liabilities, you may’re purchasing set afterwards

Repaying consumer debt feels like a training in pointlessness. Preparing a big settlement this four weeks won’t lessen your repayment the following month. Producing 12 funds in the 1st half a year of the year wont let you produce fewer obligations for all the rest. Inside perspective it think that there’s no motivator to reach debt-free beginning.

Howeverthere is.

Any time you create an earlier payment against the debt, people knocking a day off from the

Frequently you may don’t yet intend to make whole other money if you wish to hit an entire month off the expression. Appear awareness might accrue covering the lifetime of your debt, decreasing the principle initially decreases the amount of money that accumulate for the remainder of the payment condition.

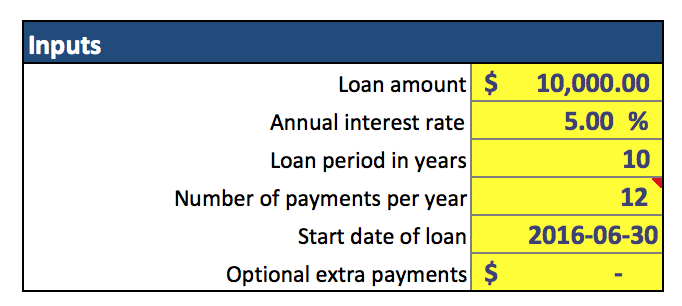

I realize this table start in 2015. Lookup pictures i’ll lower, sad guys.

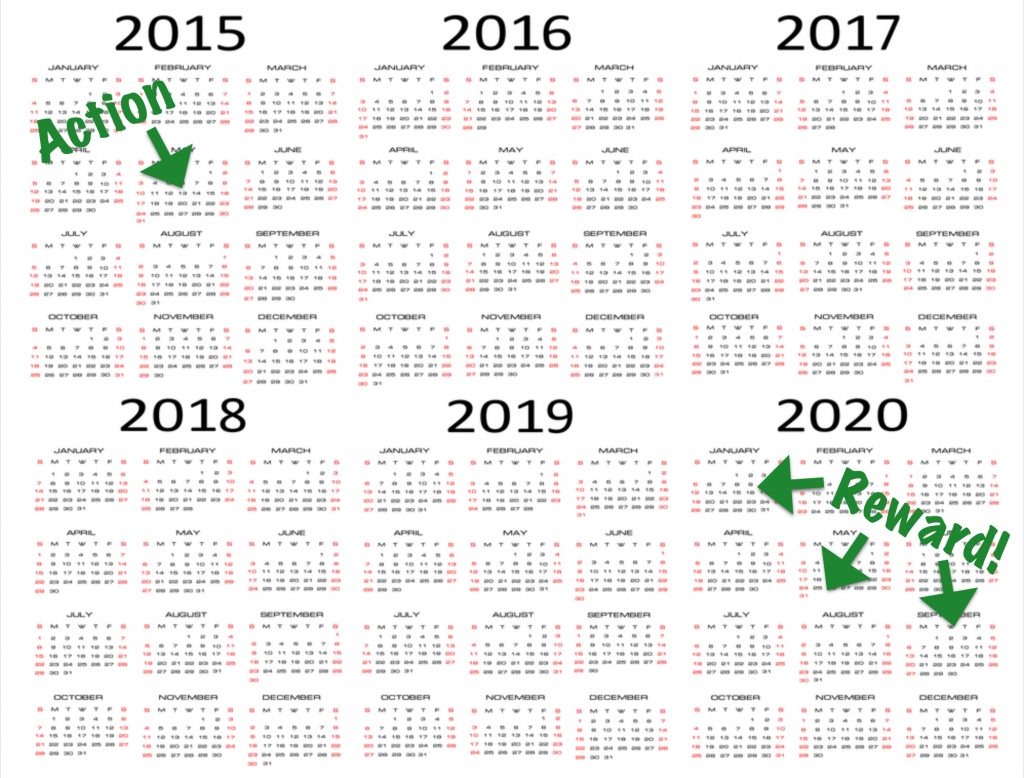

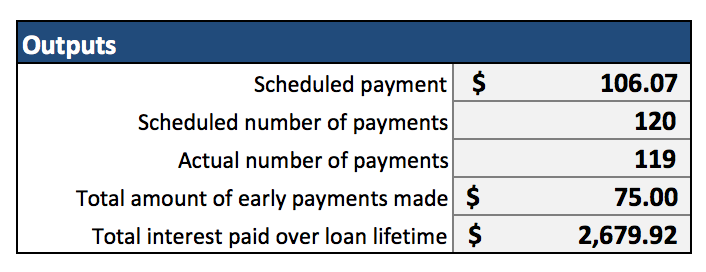

Inside $10,000 mortgage sample, one excess installment of $75 at the beginning of the repayment duration will sweep four weeks off of the loan words afterwards. Consequently anyone’re in essence obtaining $106 valuable (one fees) for $75. That’s a $31 impact or a 41procent value for your dollar.

Make this added $75 fee for 9 several months consecutively, you shave 10 time off the loan.

So long as you’re reaching frustrated with your debt, stop going through the residue. Look from the number of many months you are going to don’t must be in financial trouble for. It’ll inspire we off.

The greater several months of early obligations help to make, the faster personal debt-freedom evening brings nearer. Plus the a reduced amount of interest you wage.

Payment you’ll save on attraction by paying your financial troubles first can be real money.

The number inside your spread sheet feel intangible. Might and well revised by a change in things. They seem temperamental it doesn’t matter how regularly you may examine the [e xn y]. It’s like that they’re not really existent.

The funds it will save you by creating beginning of the bill repayments is that a real income. You are able to pass is actually on many other components of your life.

Utilising our new overhead case in point, let’s tell you choose to honor another $75 per month transaction on top of the lowest $106 transaction until your debt is usually payed off. Anyone’re getting out of debt in 63 several months, that is certainly about five years very early. People’ll furthermore write $1,300 in desire.

This $1,300 is definitely real cash. To totally understand why, you will need to return this record This how much You will definitely garner & consume component period.

Photo the loan for the paying accounts. In one single situation, us stick to the least amount program and costs you $12,727. Inside extra, you are making your current further $75/month funds as well financing can cost you alone $11,410. You can devote the primary difference to any part of your way of life. Possible spend this task on travel, wear or foods. You can save and put in them. You are able to do anything you want.

Truly, we’ll dedicate dollars. But seriously, almost any making use of it is advisable than relinquishing the situation to a creditor. I really want you to include that $1,300 into a retirement savings account. But if devote them on trip, our won’t begrudge that you. In the end, anyone’ll credibly love the holiday, whereas my concern you prefer paying rates of interest.

If you decide to graduate from college or university at 22, definitely difference between simply being credit debt spare at age 27 alternatively 32. And $1,300 wealthier.

Don’t identify you personally can’t spend that.