Your site absolutely is definitely transforming 30 on Monday, and I’m feel intellectual about my favorite teens. I’ve really been planning these days the thing I would say to your 20-year-old own about payments if I may go back in its history. Better yet, I was thinking about the suggestions I share with any 20-year-old in regards to what you need to understand about money in to your 20’s.

I experienced too much to pronounce.

The things you really should be familiar with money in to your 20’s

Anytime I posted record below, I found myself amazed how much cash for the information were only viewpoints and positions, compared to difficult, definite guidelines like “save ten percent of any salary”. Though maybe not that pleased, since however this is consistent with my favorite idea that banking campaigns can be better than monetary designs. Numbers always affair. They mean a great deal. But I presume the need behind them concerns extra. Regardless, I hope counsel can be useful and relates with 20-somethings and 30-somethings alike.

Celebrate!

1. A little bit of counts a good deal.

When you can put another $10 to your credit card debt, get it done. As much as possible invest another $10 towards your savings, do so. In 10 years, just $10 every week ends up staying more $5,000. Understandably, $10 comes long — and this refers to real with discounts AND debt. More muscular benefit of money in your 20’s usually it has got the rest of yoru everyday life to mix. Exploit quite funds to produce numerous changes in everything.

2. Fly expenses genuinely doesn’t get the Return Of Investment you think that it can do.

Investing in come frequently grows a no cost cycle as long as operating costs start. There’s viral photos that understood “Travel is the main deal you can aquire that causes you personally richer” applied all over the internet by people who don’t understand exactly stock exchange is also. Our spread a decent amount inside 20’s, except in so far as I believed I would. But the single thing that shocks me to is also where bit it has even mattered.

Finally as soon as think of it, everything I essentially study has become many, many individuals will arrive at pack European countries or go top wall of japan, but not very many begin their particular business. Put money into just the right excitement personally, miss things everyone else is carrying out.

3. Very muscular actions in your money is offer away.

With all your inbox acquiring spammed by newest features out of your favorite seller, things’s very easy to leave a cash enables you to do well over purchase jack, they could matter. Get institution an important part of your financial allowance. Must can’t afford to contribute dollars, provide your time and energy in place.

4. Purchase cappuccino each day won’t eliminate your money.

It’s vital that you lower your expenses, control a budget, and get away from attraction, but agonizing around small factors like lender rates your worth of espresso will be a misdirection from the best places to really make a difference using your management. Don’t be distressed about expenses $2.50 morning on a cup of coffee, stress about over-paying $100,000 for a property.

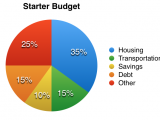

Need to make spending budget that enables you to rescue and savor funds? Have a look at assemble any spending plan program.

5. At all times cut anything.

Navigate price tags. Negotiate pay. Requesting much more at the employment the easiest way to include $1,000 to $5,000 (plus) inside annual income without working at any additional energy. This tends to generate money the 20’s together with the remainder of life.

6. Extravagant jobs are pricey.

Major paycheques, complicated duty championships, and swanky office spaces are enjoyable. They generate that is felt necessary and inspire folks at get togethers if you inform them what you create. Furthermore they can be expensive. Take the price tag on a change, expert collection, the trouble of eating out with clientele & associates, and sanity because of your coarse compensation and you are therefore turn with never as than you believe.

Be wary of the price-tag of choosing your perfect occupation.

7. Thankfulness is simpler than make much more.

Appearing relieved what you consume prices not. Anybody can give that it. We can’t all be able to invest more hours or vigour to creating additional money.

In finding a solution to income health issues, begin with you are angle initial.

8. Not make an effort to have retribution in the stock.

At times you will miss money anticipated undesirable actions. On occasion may eliminate your hard earned dollars due to trouble. Stop and shine when you switch back in. The merely an opponent your own internet “win” versus, it can don’t maintenance when you get suffer, it sound we dry. It will build your wealthier than that you by chance is without, that makes it difficult to make use of it reliably. You could potentially learn the market, but you have to learn ideas on how to do so.

9. Don’t agree with the sit that home ownership may be the tag to wealthiness.

Until you’re choosing a house with revenue, enjoying a home loan isn’t unique of letting, except you personally’re renting income in place of blank space. Normally, owning your dream house will be a difficult choice rather than a monetary one, and this clouds its wisdom in the mathematics. Leasing alternatively acquiring might be the wonder us ever do for ones financial circumstances.

10. Must’re never building a transaction, don’t look into the education loan bill.

People who are emphasized concerning their personal debt will frantically look at the proportion regularly, from time to time multiple times per day. From the i did so this using my figuratively speaking, simply see how more curiosity acquired that night. This really is useless misery and pointlessly emphasizes anyone over. It’s important to know how a lot you borrowed, however about the millisecond. If you decide to’re definitely not devising a payment, don’t stare blankly at the report words, praying these folks smaller.

11. School is among the least difficult & most expensive time-wasters at your disposal. Concept with caution.

Will facility can provide the false impression easily’re remaining rewarding or adept with payments whenever you’re never. That you won’t blink at a large number of greenbacks in tutelage and expenses as you’re “investing within future”.

Measure the valuation of your own degree, not really the value of your current wants and aspirations. Graduating into an economic depression with a low-earning education and thousands dollars of college loans is that an avoidable heck, people have got to keep away from things quick.

12. One of the best actions to take for matrimony often definitely not begin bill for your specific diamond.

Spending additional money in your wedding party does not cause even more partnered. Have fun, but don’t acquire over excited. Households scrap about currency constantly. If you decide to keep this out stressor away from your romance, that you’ll hold a shot at enjoyably actually after.

13. The simple difference between what you long for and people consume is a part stresses.

If you’d like to cost consumer debt free, very your dream house, collect a household, watch a comfy termination, and the like, the probability is one and only thing that’s ending we is usually 20 numerous hours in a week and a little creativeness.

PRESCRIBED INTERPRETATION: The $100 Startup

If you’d like to convey more revenue, take effect many more.

14. Normally become paid for your talent and gift, certainly not your time and energy.

You experience numerous a long time daily. If you are given per hour, sometimes, you might maximum off. You will not can visualize even more people. You cannot capability match many more times. You will lack time period. And don’t have your experience things you may promote.

Exchange your ideas, all of your skills, you are attitude. But prevent selling your time, and in case you need to, pass very expensive.

15. Residual income is the ideal cash.

Dividend lineage function 24/7. They will build an income for every person on trips. They might pay you in the snooze. If you buy blue-chip number forking out livestock within your 20’s, proceeding get itself within existence, subsequently continue steadily to bring on a totally free cash flow supply for a long time thereafter. Actually established as numerous passive income current because you can, and don’t on the job over again gets to be a tangible really as a substitute to a pipe aspiration. If you do nothing else for your money inside 20’s, set a financial bill that may pay out residual income throughout your lifetime.

16. Take crazy.

Many people are shattered. They might be over-worked, underpaid, struggling with debt, and have now no benefits. Don’t accept economic guidance from their site. Don’t follow the economical ideas or dreams. Don’t make whatever’re engaging in. You could try doing peculiar problems cutting down 25procent of your respective income or absolute without a motorcar.

The better items you make differently than people, a lot more likely you might be to end with a liveliness that is totally different than anyone else’s.

17. Credit mistakes may possibilities.

At 24, I got about $30,000 of personal and student loan obligation and a low-paying part-time employment. Having been embarrassed, confused, and flat short on cash. Opting to control of my own circumstances and organize my very own expenses concluded in the creation of this website, wealth After school. This amazing site took me back into school for an MBA. The MBA were I do a job at a start-up incubator. The new incubator explained i how to be operator.

This basically means, finding average joe profoundly into consumer debt throughout my original mid-twenties took incredible overall flexibility to become independent by develop 30. In the case of cash in your 20’s and property go awry, trust the journey. Worrying about your money signifies that us attention. Affectionate means you’ll probably stay very well. One’re in it for that big recreation, wait.

18. Don’t let your mother and father help you out excessively.

In the event the mom and dad are usually bankrolling a way of living you may can’t find the money for, the team’re doing a person a disservice. Becoming penniless is that unpleasant, however it’s healthy. It’ll allow you to keep working harder towards existence you’re looking for, and when find indeed there, members’ll you have to be caring and empathetic towards those that won’t have the ability to perform some same exact. If there’s point you must know about money into your 20’s, typically try making sure nearly all of certainly acquired by people.

19. Consider important, measured risks.

Any policy that needs that save a hard and fast quantity for almost any quantity of many weeks above 6 can, finally, be derailed.

Don’t create 5-year programs. Dont reach 40-year blueprints. Get 2-year design that circumstance on big accomplishment, but could constitute deserted with little abuse should you fail. Ones recruiter, personal marketplace, your lifestyle can alter on money, and determine pivot holiday strong.

20. Sooner or later you’ll go dead plus financial obligations won’t really matter.

Your sources won’t make a difference, either. Personal long and bouncy business are a blip. Possibly your next two to three models of one’s wife and kids will think back you, but then, without any you are going to. Long will leave that it will appear to be you won’t ever been around after all. Hence, this task’s important to certainly not become to hung-up on any aspect of your lifetime, but very your money. It looks like an issue, but money within your 20’s the a affair for the entirety in your life.

The problem with money is that, when there is a shortage of today, that it’s whatever you contemplate. The situation puts a stop to from experiencing the remainder of yourself. The application makes through getting a use since you’re flustered by becoming afloat. But after you have adequate to confirm by yourself, start to look at anything, things, over the declaration. You should be roughly above dollar. You may be well over your cash.

Hope you liked this carry!