PF writers can be found in all shapes and sizes. Many are juvenile and shattered individuals trying under a giant student loan financial debt (that was myself to!), others are generally drowning in credit cards and private personal loans, some never made a financial confuse as they are awesome savers, other businesses are traders and small business owners. Everybody has something to make a difference, and it’s sweet to find out from various voices for the reason that it makes it simple to get one You will definitely associate to!

However, it could be demoralizing to see a blog site that provides “aggressive” recommendation (by we represent a tirade that may simply take referred to as a common shaming of additional writers or members of the family or neighbors) on a topic the blogger never seen. One example is, there are a number of finance novelists seem at more people’s indebtedness and express “well, just pay it all, my spouse and I don’t discover precisely why this is so that tough for you” because’ve seldom even had obligation so they really have no clue where wretched it is actually.

How with indebtedness is special:

Might a sense of withdrawal

The indebted are usually expressing simply no to their selves. “I simply can’t yield things” or “it’s certainly not with my spending plan” contain external construction of an unfortunate fact: reality currency you get seriously is not genuinely your own, and therefore that you can’t shop for things would like to consume. Many people without financial debt have less difficulties for you to get entity they’ll need.

Remedy: Remember the difficulty is actually non permanent.

There are emotions of sense of guilt

We’ve so far to satisfy a person with indebtedness that seldom done an error in judgment about it. I bought fashion designer backpacks and sweet attire with many of the college loans, and I also understandthat had been incorrect. On occasion persons create start debts for crises, boarding school, and buying, but in many cases, we’ll line up the that “good credit debt” appeared to be devoted in inferior parts — together with the borrower thinks terrible concerning their options!

Remedy: one can’t affect the former, accept your silly duty (better known as desire!) and go on.

You will find typically several hire minuscule feeling of advances

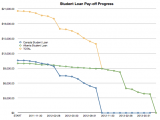

There’s few things more unfortunate than causing a huge payment against bill and rarely seeing the total amount decrease. Every time my inserted $500, $600, $700 etc against a loans I was in order bummed when they didn’t seem to minimize in. That really accepted calendar months before My spouse and I felt like I had beenn’t basically walking secure. It’s unsatisfactory.

Solution: cut how you’re progressing weekly and per year. $200 seems not, but after a few months, them’s made a dent. For added adept touch, choose simply many more appeal to you’d have and exactly what your poise would nevertheless be at if you are merely causing minimal funds.

Might a daily fee

a blogger containing merely money in the bank never witnessed certainly not an optimistic motion — a personal debt author has learned this woman is losing profits on daily basis as showing an interest is also measured and recalculated every 24hours to create them poise bigger even if she’s not necessarily expending. Where my scholarships were racking up more than $2/day in consideration, i to merely block signing-on and taking a look at these as it was then sorry. I used to be excited whenever my favorite payments stored lowering the day-by-day stake amount until it whatever pointless last but not least practically nothing.

Fix: don’t over presume them. Agitation shouldn’t bring you just about anyplace, so there’s no reason at all to think about this often. Providing you’re make payment on to the highest degree to, a person can’t operate the rest of the situation. The bank/government/credit-card-company could charge you consideration anything, which means you well become accustomed to things. If you need to be charged fewer attention, then commence reducing the debt.

How would you assume purchasing personal debt differs than devoid of this task?