I’m writing about charge cards along with some acquaintances, where one among these observed which he believed totally crucial never spend more on credit history than you can afford to pay back — except for significant purchase, like trip or laptop. I inquired how come those were the example along with his answer was going to be:

“which otherwise feel you planning to suffice? Just economize $1800?”

Comfortably.. yeah.

I absolutely don’t remember the application’s a new operation ordering an $1800 be than it is to an $18 one, previous just simply will require you manage long. I believe burden with credit ratings is things’s created instant satisfaction and approachable, most of us justify working with it to acquire items that we’d or else should wait for. This really is harmful because everything is more costly in case you purchase them in assets. These’re truly pricier multiple over: number one, boost concern of the buy you spend with the card business, but also because the interest you remove by not saving payment initial. The primary difference are pretty much minimal though the reduction grows sizable whenever you shop for bigger things.

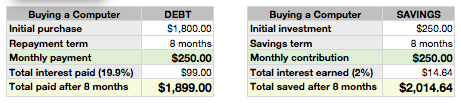

For instance, I also wish for broaden so let’s state my best mate & we each decide to buy identically individual, except he/she applies the application on his charge card is wise it well for 8 months, whereas our save up for a similar period of time. Together with shelling out money $100 not the dog for not necessarily racking up any attention, my money produces $14 inside TFSA. This is basically the end result:

Certainly not a big deviation, but one however. From inside the reductions instance, easily have been prepared produce an additional $40, I could have purchased the laptop or desktop monthly earlier on, whereas paying your debt four weeks quick would crave an extra $170. Perhaps on small-big expenditures saving up sell produces large impact.

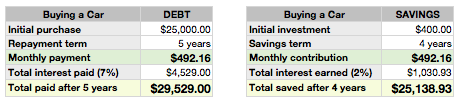

Currently envision we will travelled onwards and purchase nice smaller Coopers at $25,000 each, except ally should have her nowadays and I’m excellent with waiting until age group 30 5yrs from so, because I’m honestly firm to open flow. She joins a 5 12 months loan and complies with $492 monthly, my sock apart comparable magnitude just for four ages. Here you will find the benefits:

Take a look at that! Not merely in the morning my performed settling my automobile in VARIOUS time period to friend’s five, our cashed over $4000 less than him!

Our highlighted the payment per month and price tag in each of those four furniture because i things’s important to check out that we’re paying out similar levels every month, nonetheless journey some of us read raise significantly distinct terminate products. The volumes aside, i do believe the genuinely valuable impact here is the period of time you will get by keeping alternatively accepting. Supporter is usually cursed with a $492/mo installment for a full other season, whereas i’ve opened off $492/mo in the same season number 5 i is now able to apply towards something like a holiday — or maybe the computer during the case study above

Any time we talk about these information, people accuse myself to of being improbable. I reckon this situation’s upsetting who’s’s turn out to be healthy to transport car finance for 5 years, but strange to save almost acquire a car for 4 ages. The last-mentioned is actually a great deal more economically solid. I realize for what reason it is often bothersome just to save upwards for a car for decades, but I’m sure them’s definitely not out of the question.

I’m currently without automobile, but I don’t believe i usually is. My spouse and I observe that car or truck relation can be necessary in certain several years, and I’m getting ready thus. That is why I uniquely indicate this premier cost savings as my very own “Car/House account”. The way we wish desire to be inside spend money on EVERY a motor vehicle and place a down-payment on home, but I additionally understandthat’s inquiring about a large number of my personal younger profits thus I allowed our two major desires share the total amount. By, if I need an auto in one or two or five-years, there’s a substantial amount premade. Additionally, though hopefully to prevent refer my personal retirement plan discounts until retirement plan, the Buyer’s Plan will permit me to retreat from my RRSP for a down-payment on a home. It will help support me to bring about the accounts, though it seems like having eons to cultivate outdated.

Know people’re want to laptop, a vacation, a motor vehicle, a home, a cushty pension, etc., so walk out your way to conserve sell. Straightforward preparation as well correct impart dollars separate rather having on credit will internet we tens of thousands over your daily life.