Many individuals ask yourself how to develop a healthy stock portfolio, although action simpler than you might think. While I stated during mail detailing a financial plan for 2015, certainly my own works from inside the new-year will be rebalancing my very own stocks to maximize yield and decrease taxation. One thing I simply found appeared to be that the majority of abstraction had fixing: experienced unnecessary value assets, not enough alliance, and had been presenting more man or women broth than ETFs. I wasn’t contemplating promoting anything off and from scratch, but used to do step a fair small bit around, perfecting my possession part and building out our investment plan for 2015 and after. Here is also a summary of a system!

Creating A Balanced Stocks

Low, just what is the very best be aware of one to lead to?

Check whether you really need to play a role in an RRSP or TFSA based upon your revenue

The TFSA is merely tax-exempt from a Canadian view — if you have me repute as part of your TFSA, that you’re forking out a different withholding tax of 30% individual rewards. Ouch! You can find what returning, however you don’t acquire extra way within your TFSA to set that once again in which things is focused upon. For that reason, the situation’s easier to you want to keep US holdings in an RRSP. The downside usually foregoing any global marketing holdings portion TFSA means one’ll neglect any assets profits on those handle. Actually your choice to find out in case’s meaningful forking out 15%-30p.c. of levy on the rewards so that you can trap confident money profit on foreign holdings.

Fees on dividends in Ontario is quite depressed, so you could like to preserve dull or boring dividend-paying lineage in unqualified profiles. Furthermore, margin trading, or any sort of borrowing from the bank to get, must be conducted in an unregistered consideration. If you decide to’re using income after which dropping this situation in a TFSA or RRSP to wager on a hot standard but you miss, that money — and part bathroom — disappears for a lifetime.

For people who don’t choose to speculate excessively, it is an easy separation of sources:

- TFSA: Manitoban lineage & ETFs (within unusual retention income tax)

- RRSP: Manitoba, United states, and socialism handle & ETFs (because yield a lesser amount of unfamiliar denying assess and going convey more contribution space)

- Unfiled information: Manitoban, dweller, and Overseas repute & ETFs, and any border trading events (to pay for lowest taxes on payouts and organize hazardous investing so you’re able to state money loss if a good investment has gone terribly)

Possession Allotment: Factors To obtain

Perhaps the great Benjamin Graham, advisable mentor of Warren Buffet and writer of my very own go-to wasting record, The good capitalist, performed the praises of directory making an investment. That is certainly why during the last a couple of years I’ve gradually strayed from investing in common inventory to buying ETFs. This wasn’t always the outcome — while I started investing ETFs weren’t just as approachable because they’re nowadays and a lot of banking sources thought a person used thousands of capital purchase on. That’s not any longer typical, each and every since Questrade quit getting fees and penalties buying ETFs, I’ve previously been re-filling excellent function with varied holdings.

But there’s an even simpler way of getting into listing buying and selling: Tangerine a mutual investment fund.

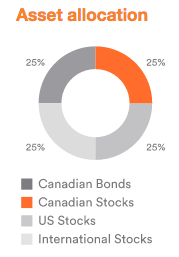

Asset assignment was Tangerine equal development function

Plenty of people will show you to not ever use mutual funds due to the very high premiums. Do so, but Tangerine helps to keep his or her MERs around 1%, that is among the many blue accessible presently. For brokers barely starting out which baffled or overpowered by ETFs or might not have $1,000 accessible around $100/mo to develop a business history with Questrade, the Tangerine funds happen to be a perfect engine starter motor vehicle for dealing. And even though I have a large function with Questrade, our even bear a part of our RRSPs in a Tangerine shared investment. I’ve had the account for over 3 years and have been happy showcasing advancement and returns.

Doing work towards At-home supply committing

Supply dealing consists of acquiring an accumulation of dollars that watch versatile indices. These maintain countless stocks that someone other than that is able you may don’t need to go with the bother of performing this your self. You’ve kept to research the fund, but exploring one finance now is easier than examining 30 livestock. Service money are threat mitigators: by running shows in different companies and businesses you personally’re little exposed to volatility, safeguarding our expenditure.

I understand the good thing about ordering popular inventory, but Our don’t have the time measure the money claims in lots of unique agencies i’d want to hold places in towards have got a reputable and well varied profile. If there’s just about anything my favorite MBA in pay has presented me personally, this’s that I am improbable to constantly make the directory. Greater I am certain, the fewer selected extremely i can gaming the unit, which is the reason I’ve become from the directory investment gold rush over the last annum and a half. This doesn’t imply people left behind widespread fill altogether, but it does mean that I simply adhere totally to my very own direction of certainly not achieving more 3% of my very own account invested 1 fill.

To construct a healthy service accounts

Searching crawl pages is not hard, since it’s a well-liked method. Probably one of the most widely used techniques for Canadians may be the Inactive created by MoneySense magazine. Besides that webpage present outstanding particular on other lineage and methods in determine investing, they can supply many Product pages just where the team construct whatever ETFs you should buy. There’s no straightforward idea than that! You may also see other instances of profile systems, such as for instance plethora Club or Forbes. If you should’re perfectly completely new to making an investment, next few one of them fully won’t star that you astray. In the event you’re a more accomplished dealer and already know just several of your very own inclinations, feel free to change these portfolios suitably. Particularly, i love to maintain 5-10% of my very own angebot in money all of the time, so I must keep carry average store for blue-chip, high-dividend paying employers.

Cultivating personal list

Obtaining a gameplan plainly states what we should get and what accounts, which makes it building the plethora a great deal easier. Since you can decide to buy ETFs as few as one device at once, or select good fund gadgets in almost any total you pick out, the situation’s easy to support a structured method to creating you are accounts. It’s as a result that you need to:

- put up routinely, either on a regular monthly or bi-weekly ground with the frequent paycheque

- reinvest all attraction & payouts

- assess at least once multiplication a year and rebalance when needed

- by no means remove to your monies

Crawl wasting really works whether you $1,000 or $1 million, which explains why things’s the chosen strategy each and every understanding person.

Ready to induce considering investment?

Attend the Victor Class income spending eCourse and find out how to work up a portfolio that offers.