We have $75,000 in all discounts and I should shell out this task in a single supply. I believe therefore favorable about that provide, I’m attending experience our income and use it to procure credit for $700,000 at 3percent, that we also will put into the capital put forth. This provides a 9.3x control and I appear good regarding this because typically this investment funds has been doing very well. I’m planning to need waste a supplementary $10,000 annually in premiums, but book this choice deserves things.

I’m involved for your long term.

If you consider accepting 10x your hard earned cash to buy one particular supply can be insane, you personally’re directly.

Undoubtedly.

However it’s just what ordering a house in Calgary, Alberta will be. If a person told you these wished to get 10x their money to shed nearly millions into distinct provide, members’d assume they were gunning for financial disaster. It cann’t consequence if that breed looks Microsoft or overall Electrical, increasingly being “all-in” with the savings the bank’s per funding is that ridiculous. Even all of us do everything the amount of time with households.

I’m by now accustomed to, and as such desensitized to, audience cost inside my town. Lots of the dwellings I would personally debate for long lasting address expense about $1 million. Whenever I discover a home on Realtor.ca in a neighborhood I adore coming in at $850,000, I simply swiftly fire down an email to my personal husband-to-be. “Look with this the!” We coo, “At single $850K, the application’s such as a steal. Might be we have to outlets unsealed audience?”

Located in an urban area with hideous household rates can do crazy points to your head. The rates be normalized to the point you could don’t function any of them rationally. If a mortgage the cost finance calculator informs you that one can find the money for a $1.2 million dollar residence, people’ll prudently fit searching guidelines at a max of $900,000.

“I’m well prudent,” you believe, “I’m searching for 25% below my favorite greatest purchase price, I’ll not be audience poor like those dummies that pick the maximal they may afford”.

When you notice a property priced at $700,000 or $800,000, you think just like your bargain-bin buying things. What’s a lot more, in the event it seems to demand any activity from gadget inform in the kitchen to landscaping design for the garage, you would imagine, “that’s ok, that’s as to why things’s priced in order lowest. We could decidedly update those the coming year”. Once you go to $600,000 residences they seem like convicted haunted household, one can’t guide but look even more secure element decisiveness.

This diamond still $599,900. I’m determined.

Sneeze too difficult and it will fall-down near you.#yyc pic.twitter.com/SeSETpe1AN

— Bridget Casey (@moneyaftergrad) March 6, 2015

Who wants to decide to purchase this for $625,000?

Nobody. #yyc pic.twitter.com/vUWhc2QbMo

— Bridget Casey (@moneyaftergrad) process 6, 2015

It’s even now a very inarticulate judgement.

It’s obtained many seasons of audience searchers in my situation genuinely grasp with the remainder of continent merely similar to this. I’ve seen individuals obtain 4 bedrom, 2,500 square ft residences for $250,000 and grumble which’s at higher end of the discount. In most states people arrange spending plans of $150,000 and also have the sensory to whine that your realtor needsn’t proved themselves nearly anything with a double-sinks during the grasp town. In Calgary, $150,000 will bring you a mobile location.

Indeed, in a truck playground.

In confidential pay blogosphere, home ownership may holy grail. Zip rather states has-their-financial-shit-together like pleasing cottage with an attached car port. “my spouse and I won’t give revenue apart by choosing!”, these people say, “You can pay all of your property or your current landlord’s!”

Folks are for the most part inexperienced or poor at z/n. Generally both.

Letting is always an audio economic decisiveness in an overheated housing industry. In an urban area like reinforce, truly tremendously more cost-effective to reserve than buy, but vigorously not many people will in truth settle on the z/n.

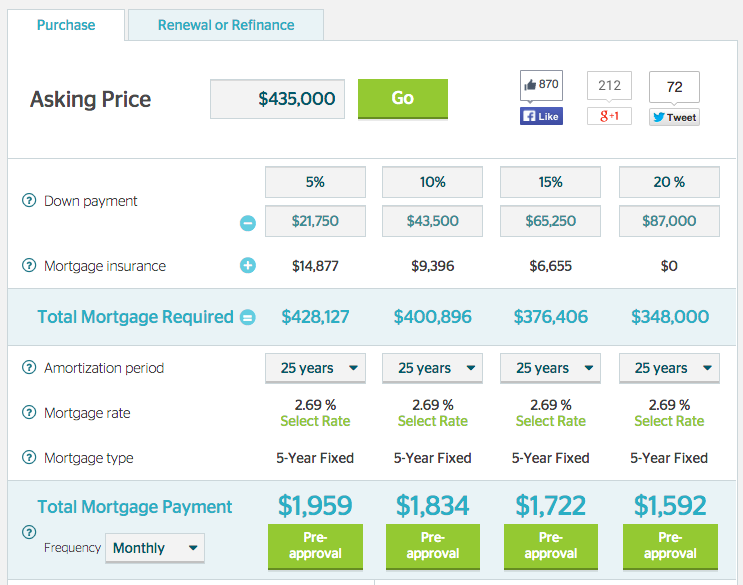

The 2-bedroom, 2-bathroom downtown condo excellent fiancé i nowadays fill would retail around $435,000. Must assign 20 percent down (that’s $87,000), you personally’ll experience a home mortgage amount of $1,592 supported at 2.69p.c..

calculations provided on RateHub.ca

With warm subterrainian room and various establishments (actually we certainly have awesome condominium table), condominium cost are usually around $500, maybe way more. Add house taxes but you’re shelling out money $2,250 on a monthly basis to live on right here. Our new rip costs $1,750/mo.

We both make use of the second $500 each month for savings and money. The $87,000 down-payment we haven’t dumped into realestate is that compiling interest and rewards within balances. We’re on this and longing.

$87,000 expended at 500 with $500/mo in advantages will grow to pretty much $98,000 in just 1 year — a gain of $11,000.

In 12 months of home ownership, with $87,000 down and a $1,592 mortgage payment, you’ve reduced entirely $9,916 was major (and $9,188 in attraction on home loan!).

Detail value of your house drops actually 1%, a person’re uglier off. And yes, lifeline rates in Calgary usually are diminishing. More on that afterward.

The landlords have this real estate overall. The team purchased around a decade inside in the event it appeared to be costing a thing little wild. Currently is actually’s a pure salary home to them, which is certainly coolheaded. Except property taxes and condo payments support climbing (even so they gracefully wouldn’t develop this rental). It’s the use when they deal at present, but didn’t. We simply contracted a lease for an additional seasons.

If I have been a house master in Calgary tonight, I’d invest my home up for sale and make use of the income and process.

The Deutsche reserve suggests the Manitoban housing marketplace is really as much as sixty percent overvalued, but many Canadians don’t give a shit basically don’t nicely the Deutsche deposit has become or wherefore that judgment issues. Closer to base the Bank of europe tells people the housing industry become a modest twenty percent overvalued, but everybody plugs their hearing and la-la-las once this is claimed that.

In condos, Canada’s traveling towards an oversupply, and is superior hardly any you is apparently conscious of. Statement of signal are primarily for locations like Toronto area and MTL, but general there’s condo overbuilding countrywide.

Fourthly, Canadians like debts. Albertans like financial debt essentially the most, they’ve loaned a shit-ton funds to its perfect houses in Stampede community.

But there’s more than this. To the highest degree key properties continue to dealing with the 2013 fill, which stressed a lot of place in Calgary’s central. And for the former seasons, petrol may plummeting. It could be that actually doesn’t signify far to you, except bewilderment your price of wind will don’t succeed, but oils is Calgary’s lifeblood. Given that the terms features fell, there’s recently been a few layoffs. After that more than layoffs. The numbers are generally spoiled than they will are available in the composition, because those single record terminations of daily staff, but there’s thousands of contractors whose shrink simply weren’t renewed. They’ve got home loan repayments, too. Home loan repayments that they can still have to meet, yet unemployed and without money.

Calgary residence price ranges have only dipped a little bit in reaction toward the class drop. Could be everyone’s in rejection. Possibly everyone’s even supporting although they get unemployment insurance premiums, but thing will most likely get unattractive any time that finish. Uglier yet after all other debt these people’ve transferred on is usually maxed down. Or perhaps not. Its possible we’ll sustain nurturing the Manitoba wish, making it real by buying-in.

Big home costs are a self-fulfilling prophecy: purchasing “before marketplace goes up” supports these charges.

Should you order anyone that owning a home looks an event, that’s a with money solid decisiveness, which it’s worth expanding who you are thin, then they’ll order in. Which will hold price ranges advanced. But there is however a restriction. We both don’t opine you will find, but there’s. Accommodate price ranges cannot heighten for a lifetime, as well real truth we need to all take is the main gather already have taken place. My families gain from housing, not us all. Consequently it’s not surprising that your own mum & step father are making an effort to help you out purchase your number 1 return: they believe them’s good funding you may’ll previously produce. It’s most likely not.

In the meantime, I’m a pleased productive tenant.