Within this Wealthsimple assessment, I exchange what exactly’s to like (as well as some property not to ever wish) about it popular roboadvisor. Members’ll buy the initial $10,000 was able at no charge!

Wealthsimple Review Statement

Pretty quickly? Here’s all you need to know about Wealthsimple:

- cram to $10,000 operated for free by entering!

- Wealthsimple pay looks a robo-advisor that inevitably commit within the markets accessible

- Wealthsimple expenses no more than 0.50procent in premiums

- Wealthsimple lets you select a TFSA, RRSP, or RESP

- you could be bought a portfolio by your aims and liability limit

- you may get profits out of your buys, and Wealthsimple will reinvest them for your family!

This compare is designed for Wealthsimple spend, the robo-advisor. If you’re selecting the business explanation, try this article on Wealthsimple commerce.

Precisely what is Wealthsimple Put?

Wealthsimple is also a Canadian roboadvisor that delivers both unregistered and registered investment data. It is an automatic spending cock for those who would like to get the market but aren’t secure the direction to go. It’s additionally a good service for professional traders to take some systems inconveniences of operating your savings off his plate!

Wealthsimple vest continues around for a couple of decades, but we recently subscribed. It’s wonderful! I’ve really been obtaining a huge selection of wants for a Wealthsimple inspection and so I last signed up discover just what all other publicity is approximately. My lingered way too long!

a 100% trustworthy Wealthsimple inspection

People consume questions regarding Wealthsimple because roboadvisors are still reasonably new to. It’s simple to be aware of committing with a brand name us’ve never heard of previously, instead of the massive 5 Financial institutions we’re all acquainted with. But once that you don’t make other fintech, a person’re passing up on some cute fantastic resources. I wish to guarantee one that Wealthsimple has become reputable and quite big! Some may actually whatever members’re searching for to build personal portfolio. Therein Wealthsimple analysis, We discuss those rewards and downsides on this over the internet roboadvisor.

This upright will never be subsidized by Wealthsimple but convinced an affiliate. Should you sign using one of many web links below i actually do become a smallish payout for the! Nonetheless, Wealthsimple provides joined beside me to offer you an essential benefit also:

Inside registration in this article and open up an account with around $100, your very first $10,000 wasted with Wealthsimple is going to be was able free.

That’s right, loose. Hate expenses? Us don’t need to pay them all on your firstly $10K! Wealthsimple features ace lowest fees to begin with, but nothing can beat $0.

Good top features of Wealthsimple

The very best feature of Wealthsimple is actually easy dealing. Every person should utilize the market, but finding out how to achieve carefully and profitably takes a choice in financial literacy. You must determine all about the stock market and then make derived selections about where you can put your money. After this task’s in there, then you definitely must re-allocating a purchases and taxation. Sounds very complicated? Certainly. But Wealthsimple perform every thing for your needs.

Wealthsimple commit is also a robo-advisor. This really doesn’t convey your hard earned dollars is usually been able by a software, although it does indicate that they’s run easily. There is certainly a genuine real time woman putting some investing options behind-the-scenes, they’ll end up being wasting your cash supported to your individual profile and personal dreams. All you need to practice is certainly transport resources to Wealthsimple accounting, which’ll care for all the rest. Should you choose to must speak with a true lead man, it is possible to. The Wealthsimple credit agents are available to answer doubts that assist you want your financial forthcoming future every step of the room.

Large humble investment charges intend extra money for every person

Wealthsimple cost 0.5procent in premiums to manage you are selection, which happens to be a portion of that asked to pay by most monetary analysts and historical mutual funds. As time passes, rates might ingest in your investment rewards so the much less you spend, the higher quality! Almost nothing get greater than 0, which is why Wealthsimple’s produce can be so fantastic:

Stated above above, you can obtain the standard 0.5% service charge waived your primary $10,000 saved with excellent connect.

Should don’t know any thing about wasting beyond easily definitely ought to be doing the work, Wealthsimple is good for one. In the event you’re a self-directed investor but want to broaden and now have somebody else go ahead and take reigns on an important part of your money, Wealthsimple is made for us, too. I robo-advisors has someplace in everyone’s selection!

INTERRELATED:

- Self-Directed Spending vs. Robo-advisor

- Wealthsimple Commercial vs. Questrade

- How to develop a $1 luxury TFSA

Tax-sheltered dealing is the best way to build your wealth expand

One of the great things about Wealthsimple is they supply listed profiles. What this means is you’ll be able to pay via Tax-Free Savings Account (TFSA), professional retirement plan Savings Plan (RRSP), or qualified understanding nest egg (RESP). Wealthsimple occasionally possesses commercial consideration, if you’re a business user you can easily farther tax-shelter source of income this place.

TIED IN POSTINGS:

-

- The latest 2019 TFSA Explained

- The TFSA vs. The RRSP

- 5 How to Enjoy our TFSA

- Save your valuable TFSA, Make Use Of Your RRSP to Buy a House

The easiest method to boost the effectiveness of these tax-sheltered accounts is to try using these to select the stock exchange. Wealthsimple pay enables you to do this. DO NOT throw away the power of all of your TFSA or a baby’s RESP in a straightforward bank account. Select the market so you truly take advantage of the tax-sheltering power of licensed consideration.

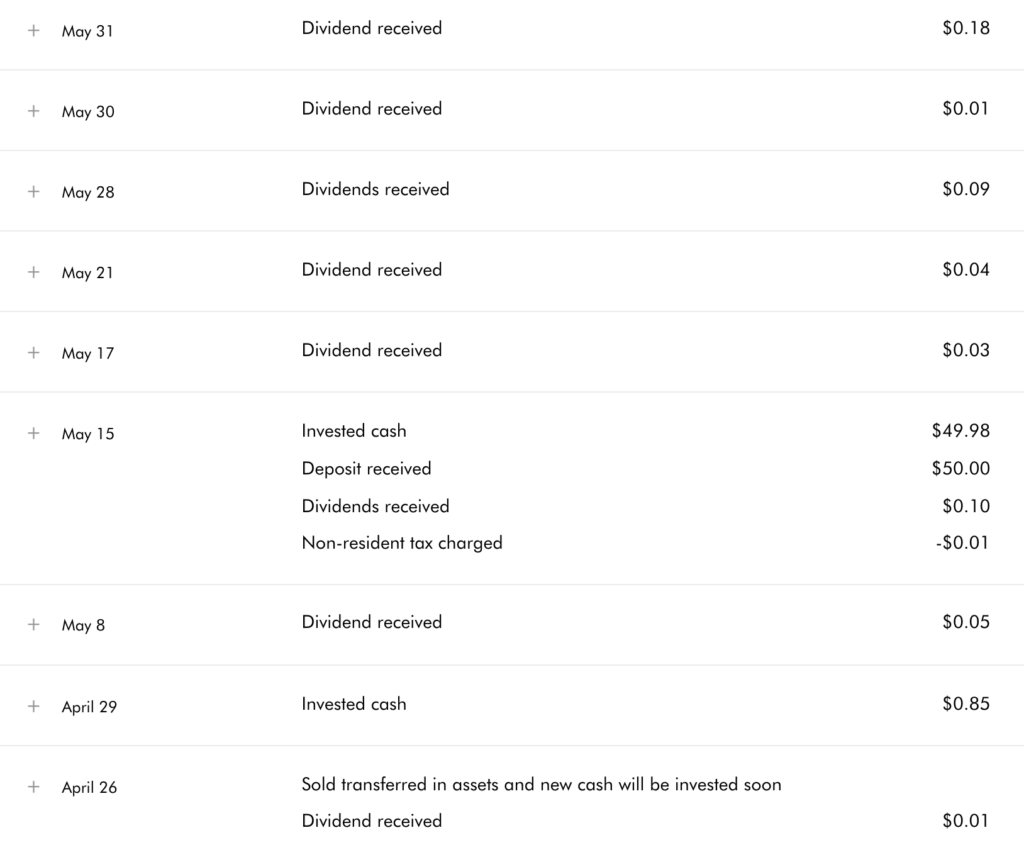

Residual income through rewards

You are likely to get off from your own buys in Wealthsimple, and so they’ll cost mechanically reinvested component portfolio. This once more is just one of the big hands-off top features of a robo-advisor. That you don’t need to do a thing except keep an eye on balance change!

My Wealthsimple Invest returns earned and reinvested conveniently inside portfolio.

Wealthsimple will also sustain any taxation you pay for shopping for worldwide stock markets, quite there’s no fretting about that either.

The best VIP treatment method: Wealthsimple angry & Wealthsimple technology

Wealthsimple presents two premium aid for exaggerated net really worth prospects: Wealthsimple bootleg and Wealthsimple technology. These VIP numerous services ask an overall invested number $100,000 and $500,000, respectively.

Wealthsimple Dirty

Wealthsimple angry boasts many of the usual options that come with Wealthsimple, along with some supplementary benefits:

- a diminished cost of 0.4procent

- the means to access terminal lounges

- duty minimization through tax-loss harvesting and tax-efficient dollars

- one-on-one economic training

You should have $100,000 invested in order to be eligible for Wealthsimple clothing, but that’s $100,000 amount across all reports. Therefore you have $65,000 in an RRSP, $30,000 in a TFSA, and $5,000 within newly born baby’s RESP, and although there’s significantly less than $100K in each, the complete adds up to over that limit so you can get most of the incentives!

Wealthsimple Phase

Wealthsimple generating is another level of Wealthsimple. It includes get incentives of Wealthsimple man (like the low commission of 0.4% and access to air port lounges), with further bougie advantages. The aspects of Wealthsimple phase involve:

- a cheaper fee of 0.4%

- use airport seating areas

- taxation minimization through tax-loss growing and tax-efficient resources

- a team of specialists designed for debt desired goals

- individualized portfolios that account for your resources (not simply those at Wealthsimple!)

- 50% off a comprehensive condition program from Medcan

Wow, i will just wish to someday enjoy which feature!

Funding personal Wealthsimple report expert

I found transporting my very own initial $100 credit to Wealthsimple super fast, so our angebot got started immediately. Once the cash starred in your consideration, I could watch account exchange by various coins on unique weeks while the share rose and low. However this is wonderful sink personal paws to market and to get an idea for following your hard earned cash fall and rise with niche fluctuations.

Wealthsimple’s help will be set it and tend to forget that it. My spouse and I raise an automatic month-to-month transport from the KOHO correspondence to Wealthsimple. Rarely I’m making an investment quickly. It is advisable to experience a long-term attitude along with your investments without be concerned about routine imbalances. Time period is on our area!

The Wealthsimple computer and mobile iphone app

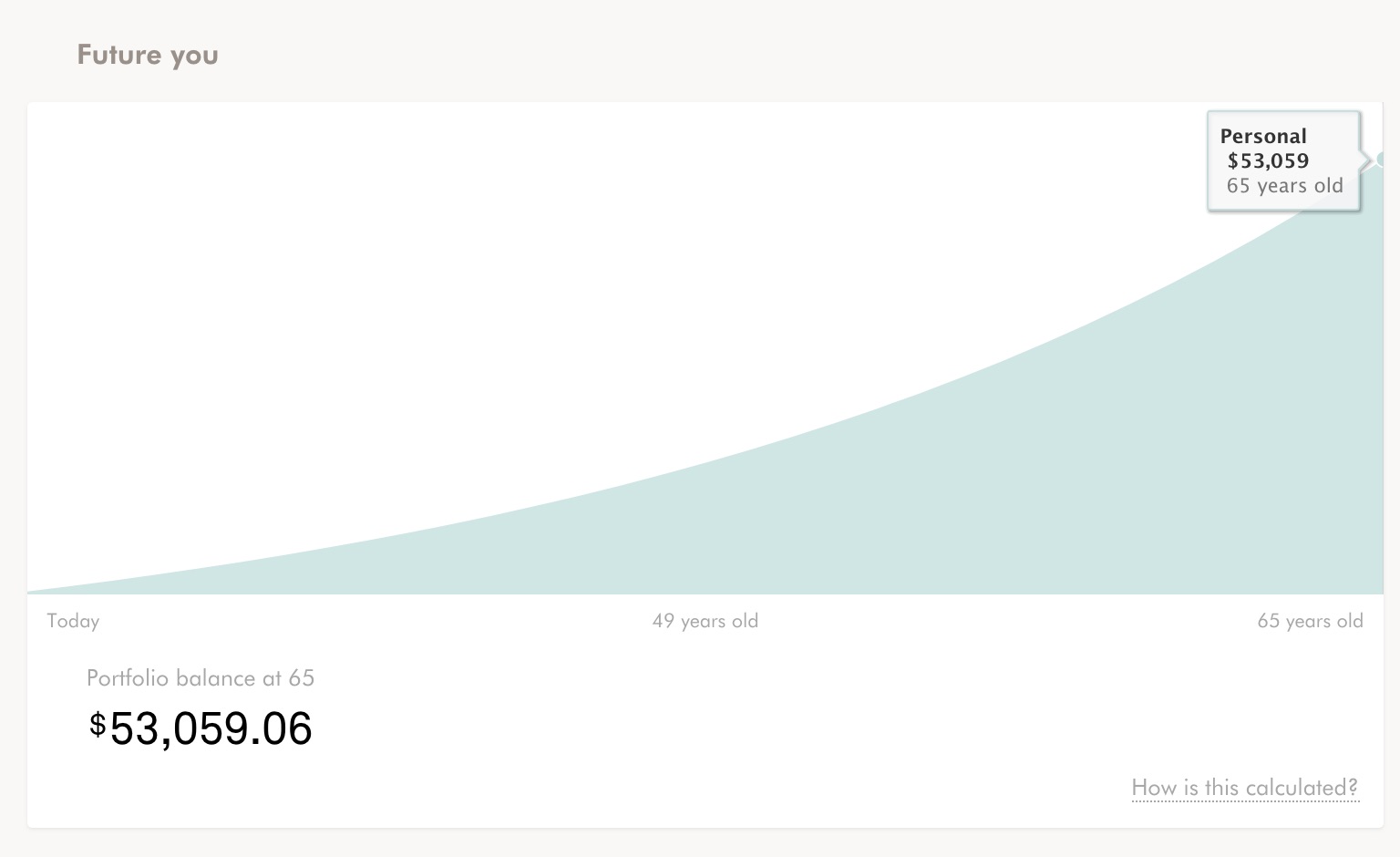

No Wealthsimple analysis is finished without revealing the application their product. The Wealthsimple program is not difficult and delightful. Them informs you just how your cash is performing, and exactly what it develops to extra with usual efforts.

My Wealthsimple commit selection develops to over $53,000 by pension with contributions of $50/month!

The application is every bit as chic and straightforward for so its possible to examine your consideration on the move. I personally fancy which they incorporate his media and reviews at once inside the application. The Wealthsimple Savings Diaries have been surely the best money number of all time. My can’t experience an adequate amount of peeking into like other folks do their money.

Saving money and Wasting with Wealthsimple

Wealthsimple also has high-interest discounts profiles so you can keep AND expend. Wealthsimple’s bright checking account at this moment possesses mortgage of 2.00procent, that is definitely more than those I’ve observed supplied by banks. This makes Wealthsimple perfect destination to commit AND salvage.

Must’ve really been stopping you to ultimately earn management on course, Wealthsimple looks entirely how to start hands free. You’ll be able to rest assured aware your financial later looks dealt with. Get back any time you’ve taken fretting about revenue and do experiencing lifetime!

Issues & Disadvantages of Wealthsimple

This wouldn’t stay a reputable Wealthsimple evaluation easily didn’t mention a few of the downsides through console.

The actual primary minus of Wealthsimple looks associated with it is chief upside: it’s all automated. Meaning there’s slight real estate investor power over what happens for your savings when you have guarantee in the accounting.

Usually, this is exactly what they want to gain. For other people like me who’ve done every single investment decision given that they got into shares, resigning the reigns to some other individual could be a little amount anxiety-inducing. Anytime I placed your very first $100 into Wealthsimple and informed me the thing broth these people were investment the wealth into, we cringed at a handful of tickers merely aren’t everything I would’ve decided for the list. This willn’t represent they’re harmful trades! It merely equals individuals’re not what we feature preferred, or these people were definitely not the allocations i might are targeting.

Minimal profiles which straightforward multiply

Wealthsimple is going to have that you finish a quiz when you enlist, which set debt dreams whilst your chance attitude. It then assigns you personally into a pre-made function. While practical, things’s reasonably rigorous. These’re also far from very fun (though “interesting” may not actually be that which you’re seeking for those who’re dealing with Wealthsimple).

Wealthsimple is extremely clear with what their portfolios encompass and just how he’re spending income. Most of the time, the team’re shopping for capture sold monies (ETFs) from Vanguard and iShares. Despite the fact that accept a rudimentary expertise in shares, that’s fundamentally an easy task to copy equivalent Wealthsimple accounts into a self-directed brokerage accounts and handle them by yourself. However, this mightn’t end up being a hands-off method buying and selling, the most significant perk of Wealthsimple.

Deciding socially dependable and clean buying

Wealthsimple pay offers optional select socially creditworthy wasting and proper pages. This will chill of positioning income into companies that experience questionable strategies. But whenever I visited this program, you didn’t observe show alteration tremendously, i however watch a number of tickers of organizations i wouldn’t classify as lawful opportunities. Also, this can be a slight problem with your otherwise plus Wealthsimple overview.

Generate probably the most out of Wealthsimple

In conclusion, Wealthsimple has become a wonderful low-fee, robo-advisor might excellent obtaining the market without the headache. Whether one’re preserving for retiring, personal child’s long term future, or simply growing our total worthy of, Wealthsimple is ideal.

Hopefully we enjoyed reading this Wealthsimple use evaluation. I we do hope you delight in Wealthsimple as far as I suffice! Exit feedback below letting I do understand what a person’re trading for. Identify if there are every other credit tips one’d at all like me to do adjacent!

Awesome

Wealthsimple is a good committing application for certainly JUST ABOUT EVERY PERSON! Whether one’re just looking to start out within markets or a are now a seasoned capitalist, this robo-advisor can be a must-add in your economical approach.

With lower extra fees of 0.4% to 0.5per cent, Wealthsimple is much less costly than conventional a mutual investment fund. His or her breathtaking, simple to understand interface claims what ones buy will grow to around point in time. Alternative to get accredited records for example the RRSP, TFSA, and RESP gain expanding your loved ones’s nest-egg incredibly easy. You can even support some financial savings quietly utilizing the Wealthsimple wise rescue presenting a 2% interest-rate.

REGISTER FOLLOWING to really get your beginning $10,000 controlled for free.

-

MAG’s decision9